ChainLink: Here's what LINK holders need to know

Listen to this article

Chainlink network growth

Chainlink (LINK) has gained some traction recently as it shares some exciting new developments on its network, each of which looks promising. For example, the network revealed that it has surpassed $6.18 trillion in activated transaction value by 2022. Furthermore, according to that, Chainlink has surpassed 4.2 billion data points distribution on the chain.

However, these developments are unlikely to impact the price chart of LINK as it is trading 4% lower from last week at $7.51 with a market cap above $3.68 billion. Interestingly, a look at LINK's online indicators also paints a somewhat negative picture for the coin, with some of them suggesting an early downtrend.

What is real cooking?

Santiment data reveals that things may not look good for LINK in the coming days.

LINK volume has plummeted recently after a sharp increase on September 29. LINK development activity has also declined in recent days, which is usually a red flag for any blockchain. Not only that, but the volume of the social network LINK also followed the same path and dropped in price compared to last week. That is not a positive sign, as it shows a drop in interest in the coin.

However, soon after, LINK's MVRV rate rose again. This can help the currency increase in value on the charts.

Brighter side?

Interestingly, data from CryptoQuant reveals that LINK exchange reserves have recorded a decline – a bullish sign as it seems to indicate low selling pressure. The same goes for LINK's net swap flow, as it's below the 7-day average - another green flag for the coin.

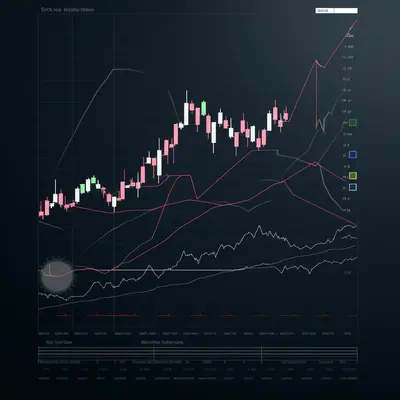

However, LINK's daily chart paints a mixed picture, as some market indicators suggest better days to come and others point to a decline. For example, LINK's 20-day EMA is higher than the 55-day EMA. This shows that the buyer has an advantage in the market.

Bollinger Bands reveal that LINK price is in a crisis zone and could soon fluctuate. However, the MACD revealed that after a skirmish, the bears gained the advantage as a bearish crossover was noted.

Additionally, the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are in neutral positions, suggesting that the market could move in any direction in the coming days.

Oct 03, 2022

Whale Transactions-400-400.webp)