Chainlink: Will LINK receive Bulls soon after this pandemic?

Listen to this article

Disclaimer: The following analysis results are the sole opinions of the author and should not be considered investment advice.

Chainlink recently

- Chainlink has posted double-digit losses over the past day, falling below the Bollinger Band baseline.

- The market-wide downtrend confirms the social dominance and growth of the LINK network.

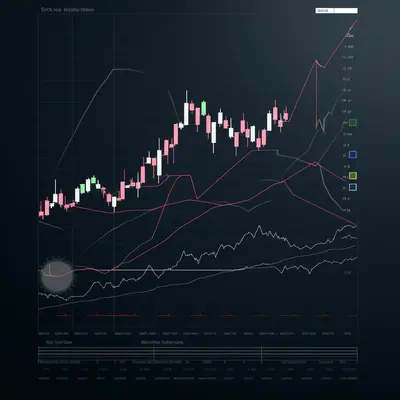

After reversing off the 200 EMA (green) in November. On August 8, Chainlink [LINK] sellers quickly sparked a rally down to the lower Bollinger Bands (BB).

While the price continues to break above the $6.6 support level, buyers will try to find opportunities for a recovery. The ongoing sell-off may be difficult to quell until a bullish rejection emerges in the coming sessions.

At press time, LINK is trading at $6.87, down 22.6% over the past day.

Can LINK reverse at support level?

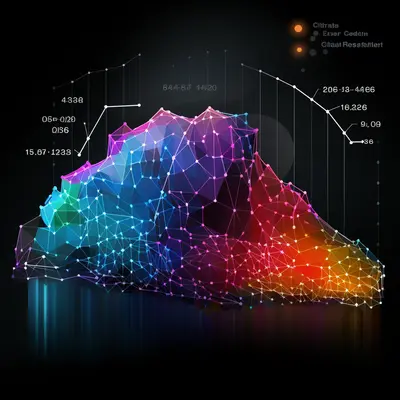

Since dipping towards its multi-year lows near the $5.89 support zone in mid-July, LINK buyers have quarreled to find new highs. The 200 EMA has restricted buying efforts on the daily time frame since the beginning of this year.

Following a nearly two-month compression in the $6.5-$8.2 range, the altcoin has finally entered a phase of high volatility. The recent bull run saw an expected reversal of the 200 EMA and the upper band of the BB. consequently, LINK dipped below the BB baseline to affirm a change in momentum for sellers.

If the buyers hold the psychological support level at the $6.8 mark, an immediate recovery may help the bulls push LINK towards the $7.3-$7.9 range in the coming sessions. Price action could hover near Point of Control (POC, red) for a while before a trend-reversing move.

A potential close below the $6.6 level could open entry doors for a test of the BB lower band followed by the $5.89 baseline.

Meanwhile, the Moving Average Convergence Divergence (MACD) made a bearish cross on the daily chart. But the lines still swayed above the zero mark. Such historical crosses above encourage short-term declines.

Chainlink network growth and social dominance

According to data from Santiment, the token has marked a sharp daily decline in its network growth and social space since mid-October. However, at the end of October, its price action has increased differently from these indicators.

If Bitcoin continues to deteriorate in the coming sessions, LINK buyers may find it difficult to increase their social dominance in the coming days. Additionally, LINK has a 66% 30-day correlation with the actual token. The movement of Bitcoin must be closely watched in order to be profitable.

However, the goals will be the same as discussed.

Nov 10, 2022

Whale Transactions-400-400.webp)