FTX becomes a partner with Visa and its impact on FTT

FTX [FTT] managed to avoid the hassles of a crypto market downturn as the exchange made headlines for its recent partnership. On October 7, FTX confirmed that it has partnered with the payment platform Visa.

According to the details of the partnership, Visa will offer debits in forty countries. In retrospect, this card would have allowed users to make purchases with their cryptocurrency.

FTT holders speculate on its utility

As it happened, some investors have called cryptocurrencies an unused speculative asset. However, Cuy Sheffield, head of the crypto at Visa, mentioned that a partnership with the company run by Sam Bankman-Fried could change the story.

In an interview with Yahoo Finance, Sheffield mentioned that collaboration is a big deal for the crypto ecosystem. Furthermore, he noted that, with the partnership, cryptocurrency could go from being known only as a transactional asset to becoming a real-world use case.

When asked about Visa's intentions to address crypto-related volatility, Sheffield said:

“Regardless of the price of any property on any given day, we see continued interest from consumers as well as entrepreneurs and builders. Many developers are entering the crypto space and will be building the future of payments. "

FTT price prediction for 2022-2025

As for decentralization, the head of the crypto mentioned that it is more of a spectrum than a binary. Sheffield added that decentralization will create more cooperation with traditional finance, which acts as a killer later on.

Previously, Visa partnered with Coinbase. The previous partnership allowed Coinbase users based in the UK to use their Visa cards to make payments in Bitcoin [BTC], Litecoin [LTC], and Ethereum [ETH]. Now, Visa aims to leverage the FTX partnership to expand across different continents.

How did the FTT do?

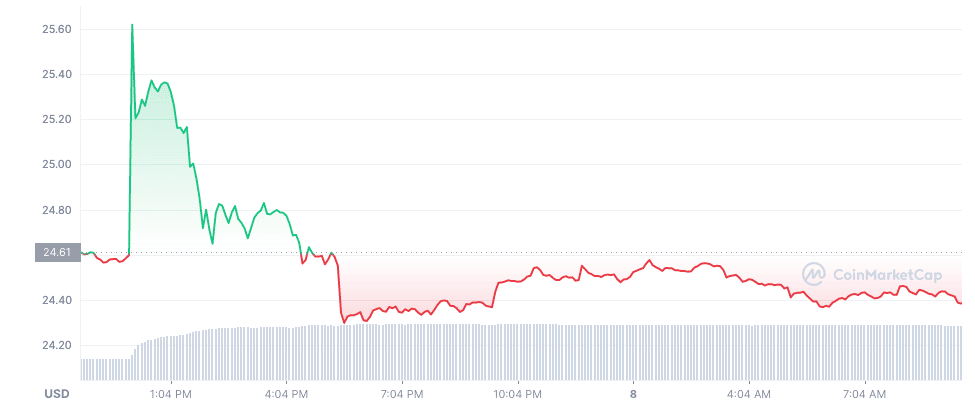

Almost immediately after the news broke, FTT skyrocketed. According to CoinMarketCap, the FTX exchange token went from $24.59 to $25.62 in a few hours. The chart indicators show increased interest in FTT during this time.

While prices have dropped significantly at press time, the volume has maintained its spike with a 167.66% increase over the past 24 hours.

On the other hand, one would expect that the FTX-Visa romance would also lead to increased FTT adoption. However, 24-hour active addresses have not increased significantly with development.

Data analytics platform Santiment has recorded daily active FTT addresses at 276 at press time. Going back to October 8, that's a 19.72% drop to 239. Interestingly, there's another aspect investors can get excited about: the market-to-real-value (MVRV) ratio. ).

Based on on-chain background observations, FTT's 30-day MVRV rate is 3.395%. Since it went from -8.06% on September 27,

FTT is likely to generate more profits for investors in the coming days. Additionally, building on the momentum of the partnership with Visa could help strengthen the forecast.

Oct 09, 2022

-400-400.webp)