LRC: Analysis of the LRC's profile in the 90 days has what?

Listen to this article

According to crypto social analysis platform LunarCrush, Loopring [LRC] is said to be bucking the trend in the crypto market as a whole. It recorded the highest number of daily social contributors (5,260 people) in the past 90 days.

According to LunarCrush, it was found that this important milestone was reached amid a decline in the number of social participants entering the overall cryptocurrency market.

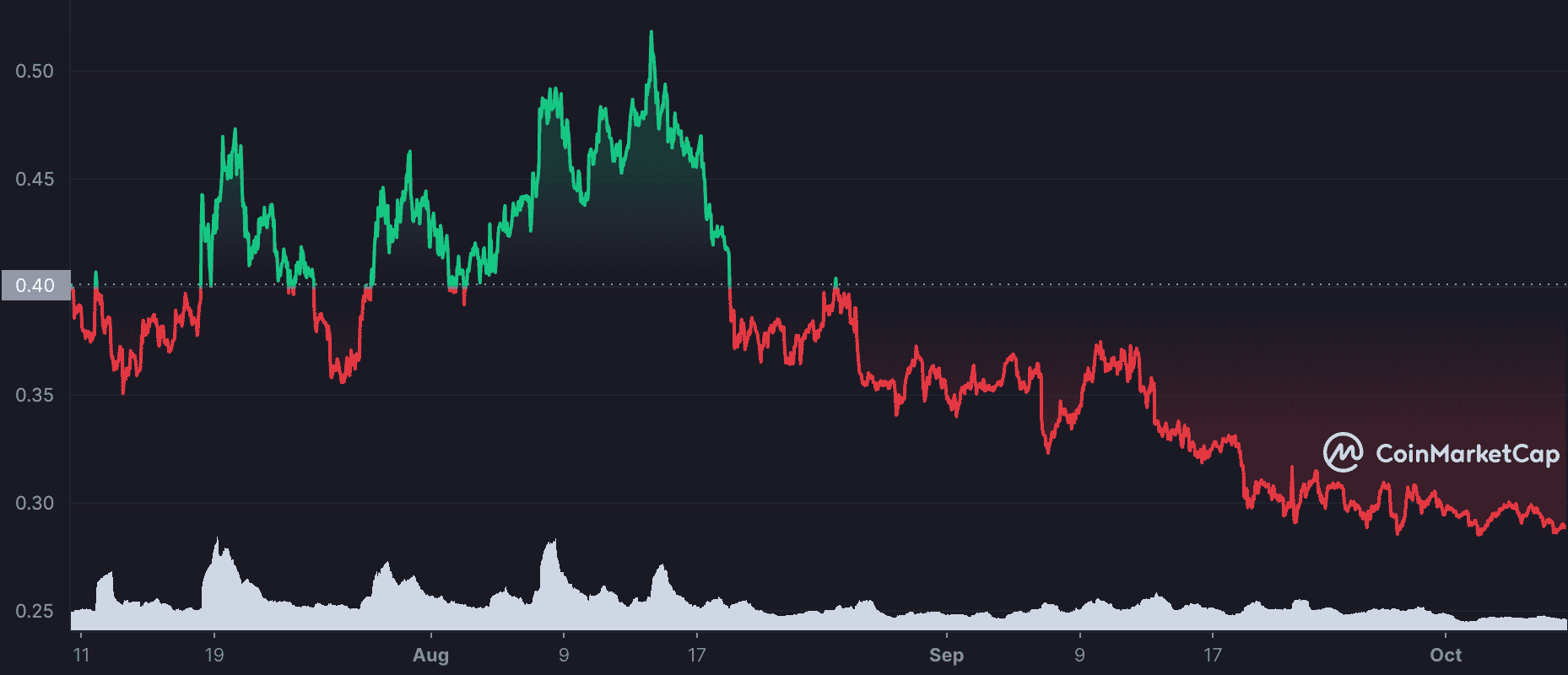

LRC chart for last 90 days

Historically, a spike in the social activity of a crypto asset has resulted in a similar growth in its price. However, in the case of the LRC, this was different. According to data from CoinMarketCap, the past three months have been marked by a decline in the price of the asset.

Ninety days ago, an LRC token could have an index price of $0.40. The general crypto market rally in July caused the price of LRC to rise.

By August 14, the asset price had reached a high of $0.51. Unable to maintain the upward momentum, the bears begin a bearish correction. LRC closed the third quarter at $0.30, down 41% from the August 14 high.

Still on the downside, the price of LRC has dropped 7% since the beginning of October. Furthermore, according to data from CoinMarketCap, LRC has been trading at $0.2885 at the time of writing.

On-chain data analysis for LRC

In addition to the overall drop in the crypto market, a review of data from the blockchain analytics platform Santiment has provided insight into the continued decline in LRC prices in recent months.

First, there is persistent congestion in the LRC network. Considering the average investment age in dollars (MDIA) and the average monetary age of the assets shows an increase in the number of idle LRC tokens.

According to data from Santiment, in the past 90 days, the LRC's MDIA has rebounded by 41%. Its average money age also increased by 25% during the same period.

The long periods of these major indicators indicate that more and more investments in LRCs are inactive. If this persists, any significant growth in the price of LRC could be affected.

As for profit taking from LRC investments, looking at the market value of assets (MVRV) above the 90-day average shows that a significant number of LRC holders have lost money over the past three months. via.

MVRV for 90 days recorded a negative value of -18.88%.

In addition to the price drop, development activity on the LRC network was also affected during the period under review. It has fallen 7% over the past three months, according to data analytics platform Santiment.

Finally, the LRC experienced a severe drop in its network activity during the period under review. Daily active addresses trading LRC down 87%. Likewise, new addresses created in the network daily decreased by 58% during the same period.

Oct 09, 2022