What is Centralized exchanges(CEX)? Overview of CEX

What is Centralized exchanges(CEX) ? Advantages and disadvantages of CEX compared to decentralized exchange (DEX)? Learn more about investment opportunities with CEX exchange coins here!

What is Centralized exchanges(CEX)?

CEX (Centralized Exchange) is a centralized exchange that is managed by a 3rd party, which can be a company or organization that owns the floor. All your crypto assets when deposited into your account on the CEX exchange are managed and controlled by that company or organization.

In a word, CEX exchange can be considered as an intermediary specializing in providing reliable coin/token exchange trading services for users in Crypto.

Some popular CEX exchanges today can be mentioned as: Binance, Huobi, Kucoin, ...

Advantages and disadvantages of CEX

Advantages

- Good interface and user experience with many utilities and features, suitable for new entrants.

- The processing speed of CEX is faster than that of DEX.

- High liquidity.

- Fast transaction speed.

Defect

- Must trust 3rd party.

- Must transfer money to the exchange wallet and the exchange will control 100% of your crypto assets.

Top 5 reputable centralized exchange (CEX)

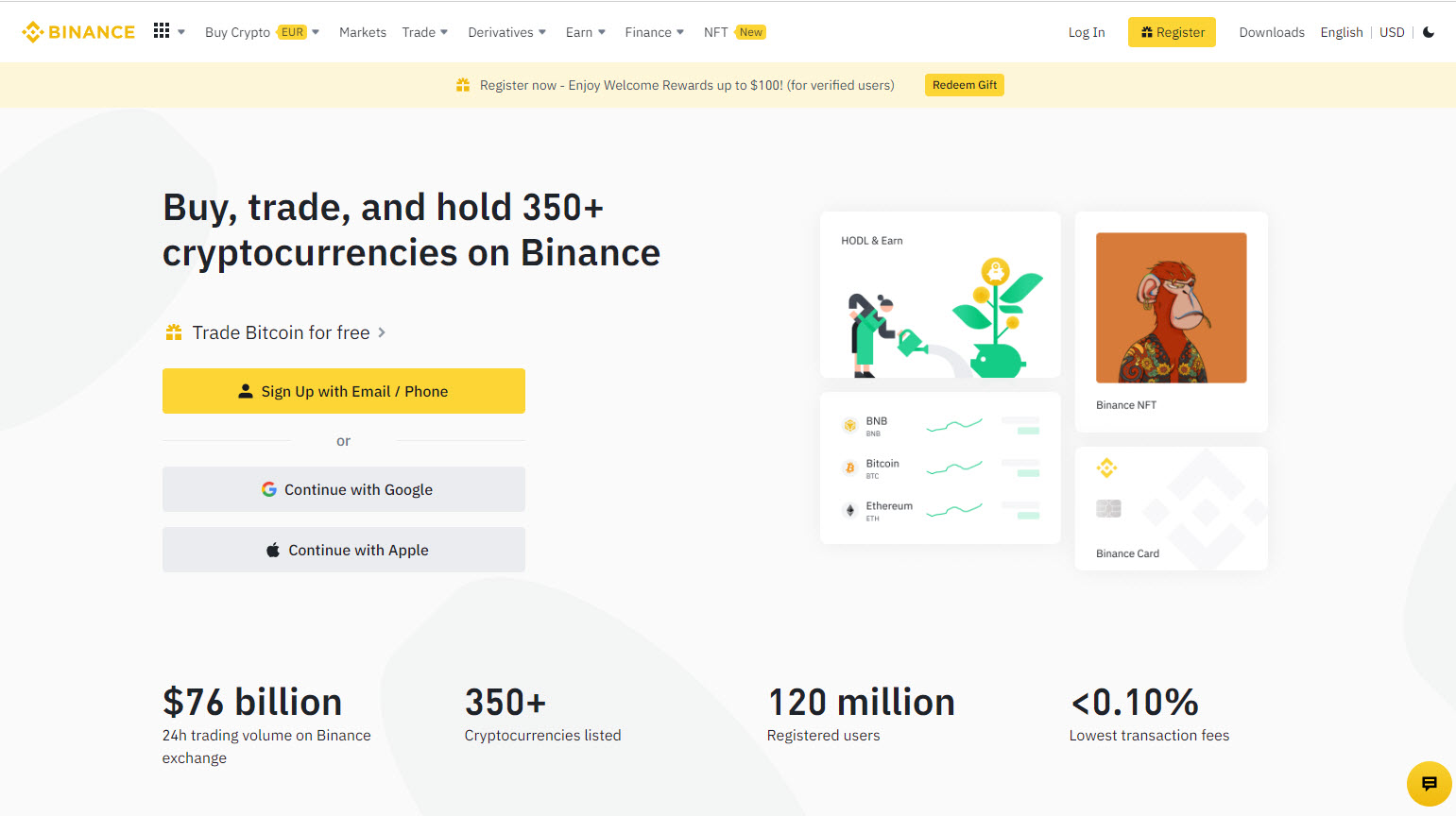

Binance Exchange

Binance exchange is a top-tier exchange in current Crypto. In addition, Binance is also an exchange that has a lot of assets that are allowed to trade with quite high volume, so the price difference when trading large quantities is not much. The exchange has Vietnamese language support and is currently the one with the highest total amount of assets traded per day.

Besides spot trading, Binance also supports users to trade leveraged derivatives. In addition, in June 2021, Binance also started to support NFT trading, thereby becoming the first CEX exchange to support NFT market.

Visit and create a Binance account here .

Huobi Exchange

Huobi exchange is one of the leading exchanges in China, whose trading volume is also in the top 4. With more than 900 asset pairs being allowed to be traded, Huobi is also the place of choice for many traders when it comes to trading. want to buy or sell tokens.

Access and create a Huobi account here .

FTX

Although born only in 2019, FTX has shown itself to be a force of CEX when the 24-hour trading volume is always in the top 5. In addition, behind FTX is Sam Bankman-Fried, and at the same time, standing behind FTX is Sam Bankman-Fried. is the owner of Alameda Research - one of the Market Makers and a well-known investor of Crypto.

Access and create an FTX account here .

Gate.io

Gate.io exchange is one of the oldest exchanges in China. The exchange was established in 2013 with the first domain name Bter.com, under the leadership of CEO Lin Han.

Visit and create a Gate.io account here

Kucoin

Like Binance, Kucoin is also an exchange from China that was established in September 2017. The platform has low transaction fees and has a built-in Tradingview chart to increase the user experience.

Access and create a Kucoin account here .

Overview of CEX exchange coins

What is CEX exchange coin?

Exchange coins (also known as CEX tokens) are coins/tokens issued by CEX exchanges, for the purpose of serving in that exchange's ecosystem.

Purpose of use of exchange coin CEX

Each exchange has a different ecosystem, so the needs & purposes of each exchange coin are different. However, they usually have some of the following characteristics:

- Reduced transaction fees: When users own CEX exchange coins, the exchange will reduce transaction fees when performing transactions. Each exchange will have a different fee reduction policy. Some typical exchange coins are: Binance Coin (BNB), KuCoin Share (KCS), Huobi Token (HT).

- Upgrade to a VIP account: When you become a VIP account, you will receive some special offers from that exchange. Popular exchanges with this form are: Binance, Okex.

- Participating in profits from the floor: This form is almost the same as dividing shares in the traditional market. Users buy & hold exchange coins, will be paid part of the floor's profits by the exchange. Examples include: KuCoin, BitMax,...

- Participating in IEO: IEO investment form has blossomed since the beginning of 2019 after 2 very successful projects on Binance, which are Bittorrent (BTT) & Fetch (FET). Exchange coins are often used directly to buy tokens in an IEO project. If you want to participate in IEO, please read the terms carefully. Exchanges with high profit IEOs like Binance, Huobi, etc.

- Exchange coins are used on the exchange's own blockchain: Exchanges are now not only a place to exchange coins, but they are like an ecosystem. Some exchanges are developing their own blockchains. With these exchanges, the exchange coins are also used as a coin in that blockchain.

How to invest in CEX exchange coin?

Depending on the token design in each exchange, here are ways to make money from exchange coins:

- Join IEO on exchanges, use exchange coins to buy IEO investments.

- Invest floor coins first, when the price increases in IEO, take profit.

- Invest according to fundamental analysis & technical analysis.

Here are the exchanges with exchange coins you may be interested in: BNB, HT, FTT, OKB, BTMX, BTM, KCS, WRX, OCE, GT, BGG, BIX, LEO, MXC, HOO,...

Conclusion

There are many exchanges that have their own coins, but not all exchange coins are for good profit. You need to research carefully before making an investment decision.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Crypto investment is a form of risky investment and you should only participate with the amount of capital you can lose.

Oct 04, 2022