What is Market Cap? How to calculate Market Cap in the crypto market

Market cap is a term commonly used in both the stock and crypto markets. Market cap plays an important role in helping investors determine the value of an asset, thereby making more informed investment decisions.

Core knowledge:

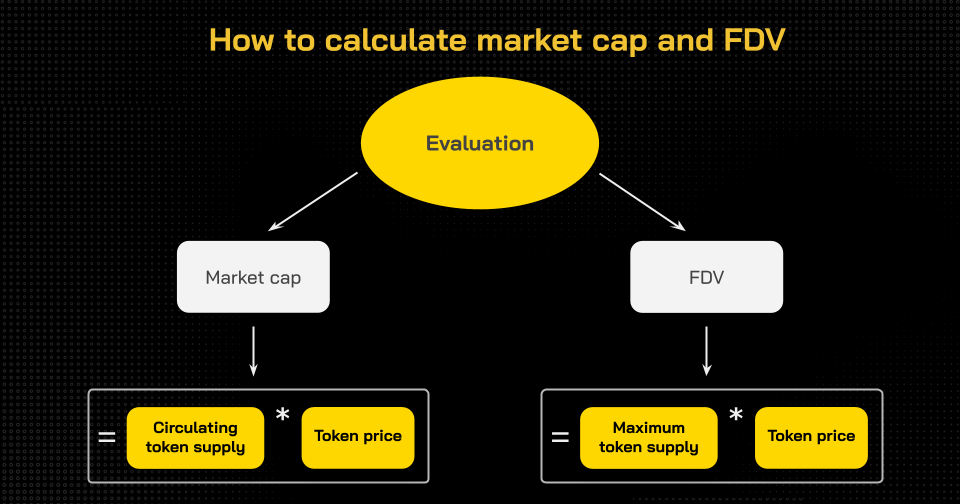

- Market Cap is the market capitalization, calculated by multiplying the token price by the amount of tokens in circulation.

- Fully Diluted Valuation is the achievable market capitalization, calculated by multiplying the token price by the total token supply.

- The Market Cap represents the value of a crypto asset or the company behind it, while the price of the token doesn't quite represent it.

- There are 3 main types of Market Cap: Large Market Cap, Medium Market Cap, and Small Market Cap.

What is Market Cap?

Market Cap is the market capitalization, which represents the value of the crypto asset or the company behind the asset, considering the supply of tokens in circulation.

Fully Diluted Valuation (FDV) is the market capitalization of a crypto asset considering the maximum token supply.

Market Cap and FDV are often used to evaluate and compare the value of crypto assets. This is the simplest and most basic way to know if a token is undervalued, overvalued or correctly valued.

If all tokens are issued and none are burned (removed from circulation), the Market Cap will be worth equal to FDV.

How to calculate Market Cap in crypto

Market Cap is calculated by multiplying the number of tokens in circulation by the token's current price, while FDV is calculated by multiplying the maximum token supply by the token's current price.

Take Bitcoin (BTC) as an example. At the time of writing:

- Bitcoin Price (BTC): 18,745 USD

- Bitcoin (BTC) Circulating Supply: 19,143,700 BTC

- Bitcoin (BTC) Max Supply: 21,000,000 BTC

By using the formula given above, we can calculate:

- Market Cap of Bitcoin (BTC) = $18.745 * 19,143,700 = $358,848,656,500.

- FDV of Bitcoin (BTC) = $18.745 * 21,000,000 = $393,645,000,000.

Why is Market Cap important?

Market Cap helps determine the market capitalization of a crypto asset class as each has a different token supply and price.

For example, the present price of Solana token (SOL) is 31.03 USD, the price of Cardano token (ADA) is 0.4633 USD. There are over 34 billion ADA tokens in circulation with Market Cap reaching $15.8 billion, while only about 350 million SOLs are in circulation with Market Cap hitting $10.8 billion.

Thus, even though SOL is priced higher than ADA, Solana's market cap is still lower than Cardano's.

Each type of crypto-asset has a different token supply in circulation and a different maximum token supply. Therefore, investors cannot judge them based on the price of the token but must rely on the Market Cap. That explains why Market Cap is such a useful tool for any crypto investor.

On the other hand, FDV can also be used similarly to Market Cap. This depends on the investor's choice. Some people prefer to calculate the value of a crypto using its Market Cap (current value), while others prefer FDV (possible future value).

Using FDV will completely remove the tokenomics aspect to get a better overview of a crypto asset as tokenomics can affect the price of the token.

Asset classification by Market Cap

Based on Market Cap, crypto can be divided into three main categories: Large Market Cap, Medium Market Cap, and Small Market Cap.

However, the definition of the size of the capitalization varies among investors. In this article, FoxCryptoNews Insights will define them as the team deems most appropriate.

Big Market Cap

Crypto assets have a large Market Cap when they have a market capitalization above $1 billion . Currently, there are 47 large-cap cryptocurrencies, led by Bitcoin (BTC) with a Market Cap of $359 billion.

Large-cap crypto assets tend to be more stable in price and more liquid, but have less growth potential.

Average Market Cap

Crypto assets with an average Market Cap are those with a market cap between $100 million and $1 billion . Most of the cryptocurrencies chosen by many investors fall into this category as they can generate relatively large returns with medium risk. The liquidity of these cryptocurrencies is also at a level accepted by most investors.

Small/Low Market Cap

Crypto assets with a small or low Market Cap have a market cap of less than $100 million . These are usually projects that are new to the market and are in the early stages of development. Investing in these projects can yield exponential returns.

However, the risk also becomes much higher. The price of these cryptocurrencies could bottom out in an instant. The liquidity of these cryptocurrencies is also extremely low, making it difficult for investors to trade. Slippage can also easily occur.

Most crypto scams fall into this category, so investors should consider carefully before speculating or investing in this crypto asset class.

Crypto Assets with Large Market Cap

At the time of writing, the top 10 cryptocurrencies with the highest Market Cap are Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), BNB (BNB), Binance USD (BUSD), XRP (XRP), Cardano (ADA), Solana (SOL) and Dogecoin (DOGE).

Investors can use Coinecko or Coinmarketcap to check these stats.

Learn more: CoinMarketCap User Guide

Frequently asked questions about Market Cap

Is owning a large Market Cap good?

The larger the Market Cap, the more valuable the crypto asset is. In order to achieve a large Market Cap or become a large-cap crypto asset class, this asset needs to be proven on many different points: Worthy, Applicability, Reputation... Therefore , owning a large Market Cap is a huge achievement for any crypto asset.

Does NFT have a Market Cap?

The answer is yes. The Market Cap of an NFT can be calculated by multiplying the floor price of an NFT collection by the number of NFTs in that collection.

What if Market Cap is zero?

If Market Cap is 0, there are three possible scenarios:

- The token price becomes 0 (the project is no longer active or becomes worthless).

- The project switched to using the new token (the old token became irrelevant).

- The project has not issued any tokens.

Is Market Cap the same as Equity Value?

Equity Value in the stock market is the same as the token price in the crypto market. As explained above, Market Cap is completely different from Equity Value, although closely related to token price. Therefore, Market Cap is not the same as Equity Value.

Conclusion

Market Cap, or Market Capitalization, is the market capitalization of a particular cryptocurrency. In other words, it shows the value of a crypto asset or the company behind it. Market Cap is calculated by multiplying the number of tokens in circulation by the current price of the token.

Based on Market Cap, crypto assets can be divided into three main categories: Large-cap, mid-cap and small-cap (low-cap) with different characteristics. Market Cap is an extremely useful tool for crypto investors as it helps them to accurately gauge the value of a crypto asset in a simple way.

Oct 06, 2022

Will Shatter Both Silver and Golds Market Cap, According to Crypto Analyst – Here His Timeline-400-400.webp)