Chainlink: Although LINK price falls, bright spot can be found in technical analysis

Listen to this article

Chainlink recently

- Chainlink has hit an all-time high in terms of daily social contributors.

- Its price continues to fall and its short-term outlook remains bearish

Recent data from crypto social analytics platform LunarCrush has revealed that LINK, Chainlink's native token, hit an all-time high of 35,540 in terms of daily social contributors.

The surge in social activity comes after Oracle's flagship network announced the first 10 participants in the first version of the Chainlink BUILD program.

First announced in September, the Chainlink BUILD program is part of Chainlink Economics 2.0. Through this program, established and early-stage projects in Chainlink receive "enhanced access to Chainlink's technical support and services in exchange for network fee commitments and incentives." other for Chainlink's service providers, such as participants." “.

LINK Price Action

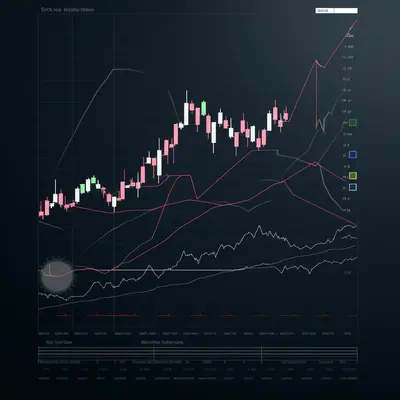

Ranked as the 21st largest cryptocurrency with a market cap of $6.08 billion, LINK was trading at $6.10 on Nov. 19. Additionally, according to data from CoinMarketCap, the price of the asset fell 2% between November 18 and 19. During the same period, trading volume also fell 27%. On November 20, LINK was priced at $6.21 and traded 1.7% higher in the last 24 hours.

On the daily chart on November 19, LINK sellers dominate the market. At the time of this writing, the 20 EMA is below the yellow 50 EMA.

Also giving credence to this position is the LINK Directional Movement Index (DMI). At the time of writing, the strength of LINK sellers (red) at 22.59 lies above buyers (green) at 12.48.

The Average Directional Index (ADX) shows that it may be difficult for buyers to reverse the strength of sellers in the short term.

Additionally, major indicators like the Relative Strength Index (RSI) and the Money Flow Index (MFI) position themselves in a downtrend. Towards an oversold position at the time of writing, LINK has seen significant distribution over the past week. At press time, the RSI is at 40.82, while the MFI is at 33.58.

It also means that the buying momentum of LINK and its Chaikin Cash Flow (CMF) will decrease. At the time of writing, the dynamic line (green) of CMF is below the center line in a -0.12 downtrend.

ChainLink onchain data

Interestingly, as the altcoin's price fell, on-chain data revealed that its foreign exchange reserves have been decreasing since the beginning of the month. With 101.99 million LINK tokens on exchanges as of November 19, CryptoQuant data shows that its exchange reserves have dropped 13% in the past 19 days.

Also, at the same time, its foreign exchange supply increased by 1.2%, Santiment data showed.

This indicates that although the price of LINK may have dropped, there are fewer sellers than buyers in the market.

Nov 20, 2022

Whale Transactions-400-400.webp)