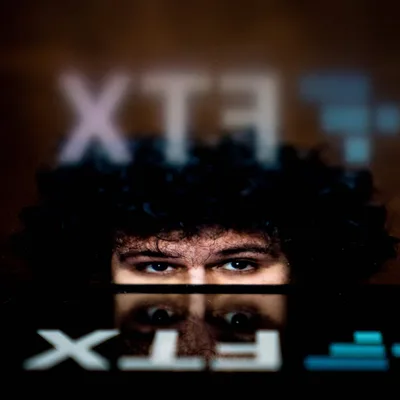

Crypto “big boys” in the US speak to reassure the community after the FTX crisis

Before the FTX crisis, many major crypto companies in the US had to speak out to defuse the current situation.

Listen to this article

Coinbase Claims No Exposure to FTX and FTT Tokens

With the "dizzying" happenings between the two largest crypto exchanges in the market, FTX and Binance, on the evening of November 9 when FTX suddenly stopped processing withdrawals due to the pressure that Binance brought through. announced the release of FTT, so that Binance reached an agreement to buy back FTX, making the market prosper a bit and also suddenly collapsed shortly after, other "big guys" were forced to speak up to reassure the community. .

And the latest representative is none other than Coinbase – the leading cryptocurrency exchange in the US. Coinbase CEO Brian Armstrong hastily made the assertion that Coinbase has nothing to do with the exchange's FTX and FTT tokens.

In addition, Brian Armstrong said that Coinbase's difference at this point in the aftermath of FTX is that the company does not engage in risky business activities, including conflicts of interest among many crypto exchanges. with each other and misuse of customer funds (in particular, mortgaging assets for investment loans).

“Coinbase has always strived to be the most trusted platform in the blockchain space and we do not engage in this type of risky activity.”

In fact, these are also the lessons that Binance CEO Changpeng Zhao shared on the morning of November 9 from the FTX crisis, including two main parts: don't use your own coins as collateral. and don't borrow money if it's a crypto company, build your own solid reserve instead.

In addition, the Coinbase CEO also stated that the exchange is holding all assets denominated in dollars and that users can withdraw their funds at any time from Coinbase without a hitch. Coinbase will never “abuse” customer funds for other purposes unless approved by the customer.

“We are incorporated in the US and listed on the stock exchange because we believe transparency and trust are very important.

Our publicly audited financials can be seen by every investor and client, which shows how we keep our clients' funds clean. We have never issued exchange tokens.”

Circle affirms USDC stablecoin “still fine”

Elsewhere, Jeremy Allaire, co-founder and CEO of Circle, the stablecoin issuer USDC, said that the FTX crisis has plunged the crypto market into serious turmoil, comparable to the “Lehman Brothers” case for crypto.

Essentially, Lehman Brothers is America's fourth largest securities and investment banking group, which went bankrupt in 2008 to set off the global financial crisis that same year. Mr. Jeremy Allaire hopes that after the crash just mentioned, the focus of the crypto industry will begin to shift to building sustainable, high-utility products designed to work on open infrastructure as well as on- chain.

To further bolster investor confidence about the fear of contagion into stablecoins, Jeremy Allaire said Circle's USDC was unaffected by the crisis, arguing that Circle is already regulated in many parts of the world. since 2014 and USDC is fully backed by government treasury bonds and cash.

The reason why the Circle co-founder has to speak out so strongly is because USDC is serving as the largest stablecoin in the crypto market and any negative impact would be catastrophic. He concluded by sharing that USDC is highly transparent and trusted by many of the world's top asset managers and custodians.

Tether claims to be “not related” to FTX

It seems that Circle's arguments are "not strong enough" to make users feel more secure when at noon on November 9, Wu Blockchain , an account specializing in updating exciting developments in the crypto market, posted. information that Circle and Tether should be more public about their financial relationship with FTX and the Alameda Research fund.

Because a lot of investors are seeing a lot of assets moving from Circle to FTX, and there are more reports that prove Alameda Research is the second largest USDT issuer in the industry.

Immediately afterwards, Tether CTO Paolo Ardoino denied the above allegations, claiming Tether did not have any contact with FTX or Alameda Research. In addition, he further explained Alameda Research has issued and redeemed a lot of USDT in the past, but none of the credits have been matured. The issued USDT is continuously redeemed according to the market demand of the customer over time, so no Tether is unaffected.

FoxCryptoNews summary

Nov 09, 2022

-400-400.webp)