Should Chainlink (LINK) cut losses or wait for a breakout?

Chainlink's 7-day performance is commendable as it significantly outperforms most higher market cap cryptocurrencies. The token registered a gain of over 13% weekly with no red on its chart.

At press time, LINK is trading at $7.18 with a market cap of $3,529,540,526. While LINK continues to grow on its leaderboard, several developments have occurred in its community. Whale interest in LINK has been growing of late. This may have fueled a steady uptick in prices.

Accelerated Development

In the last week, Chainlink development has skyrocketed as there are 11 integrations of three Chainlink services on five different chains, namely BNB, Ethereum, Phantom, Polygon and Solana.

Such developments in the ecosystem are always a positive sign as they reflect the efforts of the developers to improve the network. Interestingly, the price of LINK corresponds to this.

Furthermore, the rise is also supported by higher volume, which could make for a more steady rise. Interestingly, Whalestats tweet reveals that LINK is among the most popular tokens held by the top 500 ETH whales.

Therefore, it is clear that investors have confidence in the token as they expect it to rise further in the coming days.

Also, last week, Chainlink also overtook WETH to become the most traded token among the top 500 ETH whales.

Which indicators suggest?

The good news for LINK is that its rise is also supported by a number of online indicators. According to CryptoQuant data, LINK's exchange reserves have dropped 2% over the past seven days, which is a bullish sign as it indicates less selling pressure.

Furthermore, the number of active addresses and the total number of transactions increased over the last 24 hours, indicating more user activity on the network.

Chainlink's number of non-zero balance addresses hit an all-time high, which is a clear sign of investors' immense confidence in the coin.

However, it is impossible to say for sure in this volatile crypto industry, which is evident by looking at several other indicators.

For example, LINK's exchange cash flow dropped significantly while its price increased over the past week, suggesting a possible bear market ahead.

Looking Forward

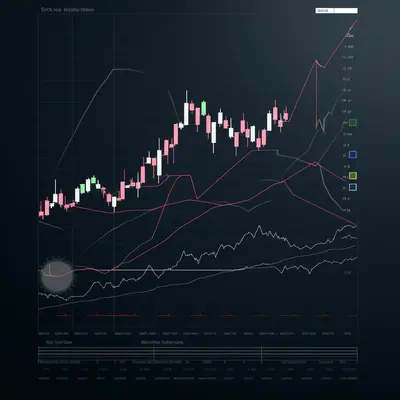

Although LINK's indicators and past performance suggest better days to come, a look at LINK's daily chart suggests a trend downtrend in the market.

The 20-day EMA is below the 50-day EMA, which further shows the advantage of the sellers.

RSI and CMF show that the market is in a neutral state. Furthermore, the Bollinger Bands show that after being in a high volatility zone, the price of LINK is about to enter a fractured zone. Hence, minimizing the chances of a short-term uptrend continuation.

Sep 05, 2022

Whale Transactions-400-400.webp)