What is Ethereum? Learn about Ethereum And ETH Coin

What is Ethereum?

Ethereum is an open source, public and decentralized Blockchain technology platform that allows to run decentralized applications (Dapps) on its platform. The Ethereum Blockchain Network is a server system with hundreds of thousands of connected devices around the globe that work to maintain its computing state.

To make it easier to imagine, instead of using a large server system like Google (a centralized system), Ethereum allows application software to run on a network of personal computers (a decentralized system). Carriers and servers are replaced by a vast decentralized network of many small personal computers that are volunteered by users around the world.

The big idea behind this project is that anyone can use the new decentralized network to create and operate decentralized applications. There is no need to ask for permission or register with another third party because there is essentially no other intermediary.

What is blockchain?

Distinguish between Ethereum and Ether (ETH)

It would be easy to confuse Ethereum and ETH, Ethereum itself is a protocol or what we often call an algorithm. It is its distributed network that is working. And ETH is the token (token) of the Ethereum platform. Therefore ETH is only one component of Ethereum's protocol structure. It is easy to imagine that Ethereum is a distributed ledger that records the history of transactions, while ETH is the data content that is recorded. Also analogously infer that Bitcoin and BTC token are two different terms.

What is the difference between Bitcoin and Ethereum?

Bitcoin is the original Blockchain network, the first Blockchain was built, published open source and publicized in 2008. So far, Bitcoin's system is considered the most massive and the most secure of all. all current blockchain systems. Since it is the original blockchain, the original idea of Bitcoin was to just stop at the level of building a peer-to-peer, unsecured, public and transparent payment system. BTC's goal is to become a global payment currency with zero inflation.

What is bitcoin?

Since Bitcoin's foundational structure is complex and "raw", it is not possible to develop applications on its own. That is the origin of the reason Ethereum was born. Ethereum inherits the existing advantages of Bitcoin, restructuring its platform more flexibly. This decision is considered an important innovation for Blockchain technology. This allows the platform to have use cases for decentralized finance (DeFi) and non-fungible tokens (NFTs) that are trending and successful today. Ethereum allows dApp applications to run on it through smart contract technology. In addition to having a peer-to-peer payment system like Bitcoin, Ethereum allows developers around the world to deploy common applications on one platform, which when using these applications users can direct payments in ETH peer to peer, and trustless. Therefore, it is possible to consider Bitcoin as blockchain 1.0 and Ethereum as blockchain 2.0.

Key points of difference:

- The supply of Ethereum was distributed during the ICO to fund the project. Miners running Bitcoin's original node hold the majority of Bitcoins in issue.

- Ethereum has no capped supply, 2.5 ETH block reward and no halving (mining reward reduction). Bitcoin is limited to 21 million BTC mined with the reward halving every 4 years.

- Ethereum has a block time of 14 to 15 seconds instead of 10 minutes in Bitcoin.

- The Turing-complete programming language structure allows extending applications with multiple classes. And of course will be vulnerable to cyber attacks. Compared to Bitcoin's structure is simple, complete and secure.

- The advantage of Ethereum's transaction fees is calculated based on compute volume, bandwidth, and storage, and is paid in Ether (ETH). Bitcoin transactions are competitive and must enter a Bitcoin block to receive rewards.

- Ethereum uses the GHOST protocol which makes Ether transactions faster than Bitcoin.

- Ethereum is against the use of ASICs like Bitcoin. Ethereum miners must use a graphics card because Ethereum's hash function requires memory usage.

- Ethereum is against centralized mining with the mechanism of the Ghost protocol.

- Bitcoin has had a history of never tampering with data on the ledger. And Ethereum had to fork after the DAO was hacked.

For better understanding, you can follow the following table:

| Name | Ethereum | Bitcoin |

| Release date | June 30, 2015 | January 9, 2008 |

| Creator | Vitalik Buterin | Satoshi Nakamoto |

| Ticker | ETH | BTC |

| Release method | ICO | Mining primitive blocks |

| Total supply | Infinite | 21 million BTC |

| Consensus | Proof of Work (Coming to ETH 2.0 with Proof of Stake) | Proof of Work |

| Algorithm | Ethash | SHA – 256 |

| Block time | 12 seconds | 240 seconds |

| TPS max. | 25 | 7 |

| Smart contract | Yes | None |

History of Ethereum

When Bitcoin launched in 2009, the crypto community was focused on providing a frontier financial model of autonomy, security, and decentralization. Many people are much more interested in how Bitcoin can develop the financial industry so that power will be taken from central authorities and redistributed to ordinary people, rather than waiting for Bitcoin to go to the moon. At the time, the focus was on the digital asset at the expense of the underlying blockchain technology powering it.

However, the more people begin to understand how Bitcoin works, the more they begin to envision other possibilities. Some have been working on adding more functionality to the Bitcoin blockchain, while others have sought to create their own variation for a decentralized network. Regardless of the approach used, the vast majority of developers stick with the original code base and architectural structure of the Bitcoin network. The obvious limitation of this widely adopted approach is that Satoshi Nakamoto's Bitcoin does not use a Turing complete programming language that can accommodate the implementation of functions dynamically.

Due to Bitcoin's infrastructure, most efforts to improve the Bitcoin network end badly. Then, a 19-year-old teenager named Vitallik Buterin devised a way to overcome the limitations of the Bitcoin protocol so that blockchain became the building block for a wide range of applications even beyond the realm of finance.

In 2013, programmer Vitalik Buterin and some members invented a new platform called Ethereum to revolutionize the operation of the current internet system.

In July 2015, Ethereum released the beta version and brought a new face to the system when operating on Smart contract technology (smart contract).

Vitalik Buterin and the concept of Ethereum

Buterin, a Russian-Canadian programmer, first heard about Bitcoin from his father in 2011. He was 17 years old at the time and despised the idea of Bitcoin due to its lack of intrinsic value. However, after the second meeting, Buterin began to understand the nature of such a currency and how it could level the playing field.

At the time, Buterin lacked the financial resources and computers to mine or buy Bitcoin. So he chose the next available option: work and get paid in Bitcoin. He was paid 5 BTC for every post contributed to online Bitcoin forums. He then teamed up with Mihai Alisie, another Bitcoin enthusiast and co-founder of Bitcoin Magazine in late 2011.

This moment of truth gave birth to the idea of Ethereum. And in less than four weeks, he has the ground to become the second most valuable crypto ecosystem. Buterin published the Ethereum white paper in November 2013 and it resonated with a lot of Bitcoin advocates. Several people inspired by this movement have joined Buterin as a member of the Ethereum founding team. Today, there are eight individuals officially recognized as co-founders of Ethereum.

Co-Founder of Ethereum

Mihai Alisie

Alisie, due to his previous partnership with Buterin and his expertise in economic cybernetics, is a member of Ethereum's founding team. He is credited with establishing the Ethereum Foundation in Switzerland. He helped establish a regulatory framework for the Ether presale and later became the vice president of the Ethereum Foundation. In 2015, Alisie started her own Ethereum-based project, called Akasha.

Anthony Di lorio

Anthony Di lorio is one of the financial backers of the Ethereum startup. He later stepped back in his chair after the team decided to opt for the non-profit business principle. Following the decision to opt for a passive role, Di lorio emerged as chief digital officer of the Toronto Stock Exchange briefly before founding Decentral, the company behind the Jaxx digital wallet.

Amir Chetrit

Amir Chetrit had a working relationship with Buterin during his time at Colored Coins. Buterin asked Chetrit to join the founding team in December 2013. However, at a co-founder meeting in June 2014, other team members and Ethereum developers questioned the lack of input from Chetrit. It was at this meeting that Chetrit agreed to give up his active involvement in the development of Ethereum while retaining his co-founder position.

Charles Hoskinson

Charles Hoskinson emerged as the CEO of the Ethereum startup in December 2013 only when he hit the exit button after the team decided to promote a nonprofit architecture for the organization. This prompted Hoskinson to create his version of a programmable blockchain ecosystem called Cardano. The platform is currently considered one of the major rival blockchains to take the throne from Ethereum.

Gavin Wood

Gavin Wood was one of the core contributors in the early stages of Ethereum's development. He earned the co-founder position for his programming contributions. He created the first Ethereum test network and even published the project’s yellow report – the specification of the original white paper published by Buterin. Wood also recommends the ecosystem's native programming language, Solidity. These days, Wood is busy working for the Web3 Foundation and its flagship product, Polkadot.

Jeffrey Wilcke

Like Wood, Wilcke became a co-founder solely because of his programming contributions. He was working on MasterCoin when he discovered Ethereum. He started writing the Google Go version of the platform independently. He is currently focusing on his game development studio, Grid Games.

Joseph Lubin

Before joining the Ethereum team, Joseph Lubin has accumulated a lot of experience in various fields. He then founded his own for-profit company, ConsenSys, which serves as an incubator for blockchain startups that want to utilize the Ethereum ecosystem. He is also influential in a number of well-known partnerships that Ethereum has secured over the years.

The main institutions that keep the Ethereum network running

These are organizations that play an important role in promoting the development of the entire Ethereum ecosystem. Some of the following organizations:

- The Ethereum Foundation (EF) is a non-profit organization dedicated to supporting Ethereum and related technologies founded in 2014 based in Switzerland. EF is not a company or even a traditional nonprofit. Their role is not to control or lead Ethereum, nor is it the only organization that funds the significant development of Ethereum-related technologies. EF is part of a much larger ecosystem. The Enterprise Ethereum Alliance (EEA) is a member-led industry organization whose goal is to promote the use of Ethereum blockchain technology and the Ethereum Mainnet as an open standard to empower ALL businesses. Consensys is a blockchain software technology company founded by Joseph Lubin with headquarters in Brooklyn, New York and additional US offices in Washington, D.C. and San Francisco.. For Ethereum, Consensys is like a nursery for projects running on the Ethereum platform.

Ethereum's Blockchain Structure

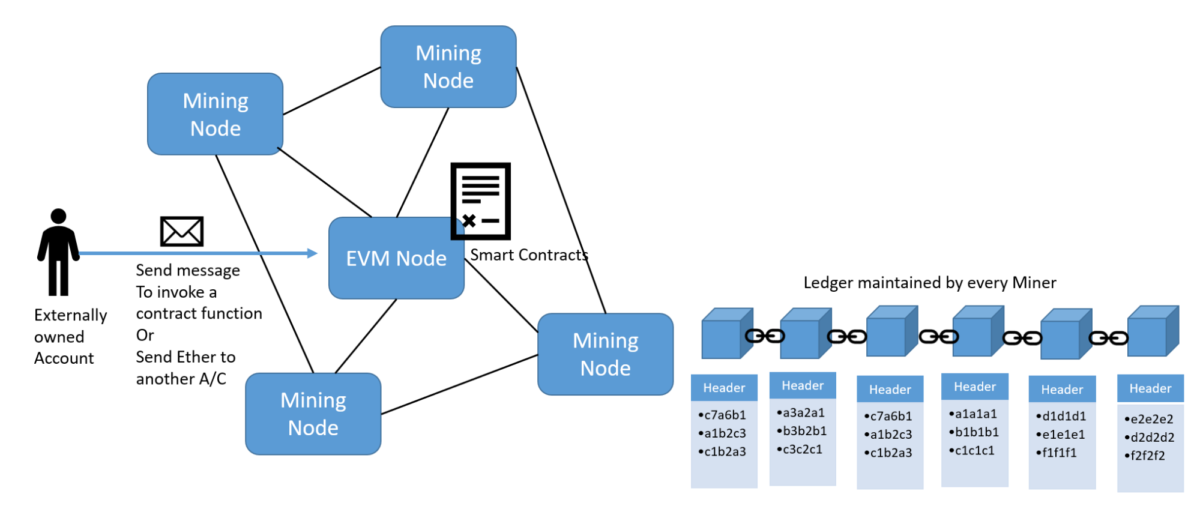

Blockchain is an architecture that includes many components, and what makes blockchain unique is the way these components work and interact with each other. Some important components of Ethereum are Ethereum Virtual Machine (EVM), miner (miner), block (block), transaction (transaction), consensus algorithm (consensus mechanism), account (account), smart contract (smart contract), mining (mining), Ether, and gas.

- Mining node: Computer clusters maintain the network of computers, similar to current servers. EVM Node: A cluster of computers running smart contracts that interact with the Ethereum core network. Block: A combination of transactions (Transaction) packaged and encrypted in the form of a hash function is a 24-letter character string. Transaction: A transaction, an operation that transmits a message, for example a message from Alice to Bob including data parameters on the blockchain. Consensus algorithm: A consensus mechanism that sets rules so that Nodes communicate with each other (current mechanism is Proof of Work with Ethash hash).

- Mining: The process of confirming transaction data, consensus across the network. Ether: Token, ETH token Gas: Transaction fee used when a user submits a transaction

A blockchain network consisting of many nodes that belong to miners and a few nodes that are not miner but help execute smart contracts and transactions is called an EVM. Each node is connected to another node on the network. These nodes use a peer-to-peer protocol to communicate with each other.

Summary of how Ethereum works

Ethereum builds on the built-in Turing complete programming language. Allows any programmer to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats, and state transition functions. thai.

Each Miner Node maintains one version of the ledger. The ledger contains all the blocks in the chain. With multiple miners, it can happen that each miner's ledger may have blocks that are different from the other. Miners synchronize their blocks on an ongoing basis to ensure that every version of the miner's ledger is the same as the other.

This activity is called maintaining computer state (consensus), the computer state is a snapshot of the balance of all accounts on the entire system (including the balance of tokens that have been mined or not yet). When a transaction occurs, the entire computer will update the status of this transaction.

What is the EVM virtual machine system operating state of the computer?

The state represented as an account is an Account 20 bytes in size including the fields:

- The nonce, a counter is used to ensure each transaction can only be processed once Current account balance Contract number of the account if any Account storage (empty by default)

In which, the coin or token Ether (ETH) is the fuel for the entire network operation, and at the same time is the fee (Gas) to be paid when making transactions. The special thing is that Ethereum has accounts that are smart contracts represented in the form of code, in addition to the state of the wallet address (Account) similar to bitcoin accessed by the private key, the smart contract will update Its private state is controlled by a private key or multiple keys.

The smart contract is optional, and it runs on the EVM's execution environment and controls its own transactions. Whether or not to write data to the chain, establish business rules and control the ETH it holds.

Mining is exactly the process of validating transactions. Its protocol is similar to Bitcoin, when the system with a lot of transactions is done, the computer will arrange and pack the transactions called blocks. Each such block is generated approximately every 15 seconds, with each block containing information about the timestamp, a reference to the previous block (via a hash) and a list of all transactions that have taken place since the last one. . This hash function is a cipher that uses the proof of work (SHA-256) consensus algorithm, which algorithm for a given random number, so that when the result is returned, the block is formed that cannot be reversed. block history. Completing such block will receive ETH reward and transaction fee.

What is the rationale for Proof of Work?

It is the same Proof of Work consensus mechanism that helps with high security but makes Ethereum's network energy-consuming and expensive, so now Ethereum is aiming for a Proof of Stake-based consensus solution to increase openness. which we are commonly known as Ethereum 2.0

Smart Contracts and the Structure of Ethereum's Current DeFi Layers

Smart contracts are considered an important application of blockchain 2.0. It is easy to understand in Bitcoin's Blockchain, the system that operates the rules to ensure peer-to-peer and trustless transaction agreement means that there is only the function of sending transactions from Alice to Bob and vice versa. This is the stub contract of the original Blockchain system.

With Ethereum, programmers can design more complex rules through the Turning Comple language like DeFi protocols that develop today's applications, non-fungible tokens (NFTs) such that all These rules are all encoded in the form of machine state by a piece of code, so the entire smart contract of the Ethereum system will ensure the rules for operating the machine state. So we have "Contract Address" when learning about a certain type of token or application.

Learn More What is a Smart Contract?

We will be introduced to an overview of the layers of DeFi architecture, which smart contracts are currently creating. Each class has a distinct purpose. The layers build on top of each other and create an open and highly aggregated infrastructure that allows anyone to build on, reshare, or use other parts of the stack. The important thing is to level it security from layer 1 out to the outermost layer.

- Settlement layer (Layer 1) consists of the blockchain and its native protocol assets (e.g. Bitcoin (BTC) on the Bitcoin blockchain and ETH on the Ethereum blockchain. It allows the network to store information about ownership of a secure way and ensure that any state changes follow its set of rules.Blockchain can be seen as the foundation for trustless enforcement and serves as a mediation and dispute resolution layer. . Asset Layer (Layer 2) includes all assets issued on top of the payment layer. This includes the native protocol asset as well as any additional assets issued on this blockchain (commonly referred to as tokens). The Protocol layer (Layer 3) provides standards for specific use cases such as decentralized exchanges, debt markets, derivatives, and on-chain asset management. These standards are typically implemented as a set of smart contracts and can be accessed by any user (or DeFi application). Therefore, these protocols are highly interoperable. Application Layer (Layer 4) creates user-oriented applications that connect to individual protocols. Smart contract interactions are often summarized by a web browser-based user interface, making protocols easier to use. Aggregation Layer (Layer 5) is an extension of the application layer. Aggregate sites create user-centric platforms that connect to a number of applications and protocols. They often provide tools for comparing and ranking services, allowing users to perform other complex tasks by connecting to several protocols concurrently and combining related information in an unambiguous manner. clear and concise.

Thus, the structure of Ethereum is more complex than Bitcoin with many layers of operation. Allows to perform many different functions.

Ethereum Ecosystem?

Ecosystem is the concept of a whole range of decentralized finance (DeFi) applications. With the ethereum layer structure mentioned above, each developer researches and develops their own applications. Here are the areas that are developing on Ethereum:

- Asset Management Analysis Decentralized Exchange Tools for tools and structures for DeFi Decentralized lending Tokenized assets Marketplace KYC & Identity verification Pay Stablecoins Derivatives and Margin Trading Platforms governed by DAO Insurance platform Forecasting markets

Currently, not only Ethereum, many other Blockchain platforms are emerging and showing their competitiveness such as Binance Smart Chain, Solana, Polkadot, etc.

DAO and Ethereum Classic? Ethereum hard fork event

In 2016, a decentralized autonomous organization called The DAO, a collection of smart contracts developed on the platform, raised a record $150 million in a crowdsale to fund for project. DAO was mined in June 2016 when $50 million in DAO tokens was stolen by an unknown hacker. The event sparked a debate in the crypto community over whether Ethereum should perform a controversial “hard fork” to recapture the affected funds.

It resulted in the network splitting into two blockchains: Ethereum with the theft reversed and Ethereum Classic continuing on the original chain (accepting hacks). The hard fork created competition between the two networks. After the hard fork, Ethereum forked twice in Q4 2016 in response to other attacks.

What is Ethereum 2.0? And its future

Ethereum 2.0

Ethereum is in its successful development stage, and as mentioned above the use of proof of work has caused the computer system to consume energy and overload when the number of users every day becomes large.

Ethereum improvement proposals and solutions in terms of block size scaling, consensus mechanism and changes in the open source development process are currently underway for a major upgrade to Ethereum called Ethereum 2.0 or Eth2 .

The main purpose of the upgrade is to increase the transaction throughput for the network from currently around 15 transactions per second to tens of thousands of transactions per second. The stated goal is to increase throughput by splitting the workload into multiple blockchains running in parallel (known as sharding) and using a common proof of stake mechanism (proof of Stake), to be able to maliciously forge any single chain, requiring one to interfere with the general consensus, which would cost the attacker much more than they could gain from a single call. attack.

Ethereum 2.0 (also known as Serenity) is designed to launch in three phases:

- “Phase 0” was launched on December 1, 2020 and spawned the Beacon Chain, a proof-of-stake (PoS) blockchain that will act as Ethereum 2.0’s central consensus and coordination hub. “Phase 1” will create fragment chains and connect them to Beacon Chain. “Phase 2” will implement state enforcement in shard chains with the current Ethereum 1.0 chain expected to become one of Ethereum 2.0’s shards.

Comments on the future of Ethereum

Ethereum is considered the network with the largest decentralized finance (DeFi) ecosystem today. DeFi has become a popular keyword with users. Although there have been many holes since its inception and experienced hard forks. But Ethereum is still the top platform that programmers choose to build their applications. Here are a few reasons Ethereum proves to be the DeFi market leader going forward:

- Having a long history of development, founder Buterin is still continuing to upgrade and work on the Ethereum network. The most diverse ecosystem and the largest number of users today. Ethereum is maturing and becoming an important financial network as most decentralized financial applications are chosen by businesses to Blockchain their services.

Ethereum Token Standard (Ethereum Token Standard)

A token standard is a concept that categorizes smart contracts based on its symbology. A smart contract is a set of rules that establish rules built on Ethereum that represent computer state.

The first is the ERC (Ethereum Request for Comments) standard, which is the set of rules needed to deploy tokens on the Ethereum network. On Solana network is (SLP), on Binance Smart Chain is (BEP). This is the notation that represents the developers' standards for deploying smart contracts on the Ethereum Blockchain platform.

Before becoming an ERC standard, smart contracts must go through an EIP (Ethereum Improvement Proposal) test. Called beta before mainnet.

What is ERC20?

ERC20 is a list of smart contract rules, smart contracts will be represented as a 24-character code. ERC20 is intended to classify the functionality of this type of contract. It is used to issue tokens on the Ethereum platform, first proposed by Vitalik Buterin in June 2015.

ERC20 smart contract allows programmer to create Ethereum platform tokens/issues. Called fungible tokens. It was this standard that became a revolution, for the 2017 Ethereum token ICO.

The ERC20 Code of Conduct is a list of ERC20 standards, with 6 mandatory and 3 optional.

In total, there are 6 mandatory rules as follows:

- Total supply: Total number of tokens issued. Balance of: Check the balance of tokens in each Ethereum wallet. Transfer: Ability to transfer balances from one person's wallet to another. Transfer from: The feature shows the balance transferred from a certain wallet. Approve: A feature that allows smart contracts to access certain token balances in wallets, check balances, confirm availability, and authorize transactions. Allowance: Check the token balance to see if the wallet address has enough tokens to transfer. There are 3 remaining rules that may or may not be: Token Name: Token name. Symbol: Token code. Decimal (up to 18): The smallest decimal number.

To check the information of any Contract, you can visit Etherscan, find the token you want to see.

What is ERC721 standard?

ERC721 is a set of standards for the issuance of Non-Fungible Tokens (NFTs) on the Ethereum platform, proposed by William Entriken, Dieter Shirley, Jacob Evans and Nastassia Sachs in January 2018.

NFT token (Non-Fungible Token)

Non-Fungible Token (NFT) is a unique, non-fungible token. Therefore, one NFT cannot be swapped for another NFT.

Thanks to the ERC721 standard, developers on Ethereum have opened up a new ecosystem of dapps using NFTs.

Up to now, the number of ERC721 standard contracts on Ethereum has exceeded 2,936.

Some other ERC standards

In addition to ERC20 and ERC721, Ethereum has 2 other token standards that I think you should know about, including:

ERC777

The ERC777 standard is a standard that improves the problems encountered by ERC20 and it is expected to overtake ERC20 by its superiority.

ERC1155

ERC 1155 is the standard for many types of tokens including Non-Fungible Token and Fungible Token.

It is a combination of the ERC20 and ERC721 standards.

The ERC1155 standard was proposed by the CTO of the Enjin Coin project to the Ethereum community in June 2018.

In addition, you can go to https://eips.ethereum.org/erc to refer to the new EIPs and ERCs of Ethereum.

Where to store Ethereum (ETH)?

There are currently 3 ways to store Ethereum:

- Exchange: when trading and creating an account on any exchange, users can keep it at that exchange. Note, choose a top exchange, reputable and secure. Hot Wallet: Is a mobile application such as Coinbase Wallet, Metamask Wallet, Trust Wallet, MyEtherWallet, etc. is one of the mobile applications that allows depositing and withdrawing ETH in particular and outstanding ERC-20 tokens in general. best. Cold wallets: As USB-like data storage devices, typically Ledger Nano S, Trezor is also a reliable place to store Ethereum cryptocurrency.

Ethereum (ETH) Basics

- Name: Ether Ticker: ETH Algorithm: EThash Consensus Mechanism: Proof of Work Launch date: 30/07/2015 Block Reward: 2.42 Total Initialized Supply: 75,000,000 ETH Current circulating supply: 116,203,674.03 ETH Official Website: https://ethereum.org/en/ Explore url: https://etherscan.io/

Distribution of Ether (ETH)

Ethereum has a total supply at the time of creation of 75 million ETH. Of which 72 million ETH was sold during the 2015 ICO. The ICO price was 1 ETH = 0.311 USD

- Genesis: Initial Block ($60 million in Crowdsale and $12 million in another): 72,009,90,50 Ether Block Rewards: Mined Block Rewards: 41,323,993.91 Ether Uncle Rewards: Number of undistributed block rewards: 2,869,689.63 Ether Total Current Supply: 116,203,674.03 Ether

Should you invest in Ethereum (ETH)?

Investing and buying and selling ETH is like all other cryptocurrencies. The market cycle will have ups and downs. The fact that the cryptocurrency ETH is not immune to its rules, especially the price of the cryptocurrency sector often has a large fluctuation range. Currently, cryptocurrencies in general and ETH in particular are only interested by the community as a form of speculative goods, the legal system has not yet accepted payment of cryptocurrencies.

Take a look back at ETH's capitalization history from 2016 to early 2021 in the chart below. Shows a long-term growth. The early part of 2018 ended the bull cycle, and it was not until the end of 2020 that ETH regained its position.

At the time of writing Fox Crypto News, the capitalization of ETH reached 305,391 billion USD, accounting for 18.6% of the total market capitalization and ranked 2nd on the ranking of crypto assets with the largest capitalization after Bitcoin. Therefore, in the long term, the growth of ETH will have deep and continued downward corrections in the future.

Based on the above figures, the purchase and sale of ETH coins will depend on each person's personal opinion. All information has been compiled by Fox Crypto News and does not constitute investment advice. Fox Crypto News is not responsible for the investment decisions of its readers.

How to Own Ethereum (ETH)

Become a Miner

ETH mining is the setting up of computing devices connected to the Ethereum network to run network nodes for mining rewards and of course inclusions. Indispensable hardware devices such as CPU, RAM, storage, PSU, cooling fan, graphics card such as lNVIDIA GeForce GTX 1080, or the latest versions. The principle of ETH mining is to solve the Ethash algorithm with SH256 hash. Two important components to the power of the machine to solve the algorithm are power and device configuration. Therefore, when setting up network nodes, it is necessary to have high power and configuration, the competitiveness will be higher. Besides, setting up the software to run the algorithm is very complicated, requiring you to have experience in programming. The average cost of setting up a machine is about 2000-4000 USD, it takes about 60-70 days to mine one ETH, this number is only relative, when the network is joined by more miners every day, not to mention the risk in the future. operating software errors, overloads and equipment failures. So if you are not an expert and have a large capital, at the moment, participating in mining is very risky but not profitable in terms of revenue. One solution is that often miners pool machines to run on the same network node, which is also a possible solution.

Trade on cryptocurrency exchanges

Currently, owning popular cryptocurrencies is directly traded on exchanges. This operation is similar to trading common financial commodities such as stocks. Sign up and open an account, deposit, and trade on ETH pairs with other currencies.

Because the cryptocurrency market is still very young, so prices often have large fluctuations, buying and selling cryptocurrencies is not immune to risks when the market plummets. As a cryptocurrency trader, you need to take the time to study and understand the rules of the market as well as understand the risks when conducting trading on cryptocurrency exchanges or any individual organization. Currently, Some country's law does not protect trading activities in the field of electronic money. Again, be careful with your investment decisions. Subscribe to Fox Crypto News to stay up to date with daily crypto market movements.

Earn ETH through DeFi Financial Products

Decentralized finance (DeFi) are financial applications/products built on Blockchain, allowing token holders such as Bitcoin, ETH, XRP, USDT, etc. to maximize their profits as an image. Savings, loans, loans and other financial products on blockchain.

Currently, exchanges support the deposit of ETH as a form of savings, besides the current popular DeFi operations of applications such as decentralized lending, productivity farming. (Yield Farming), Provide liquidity (Liqudity Provider), provide Cover insurance, derivatives trading,…

Participating in decentralized financial products is also not without risks, such as stolen accounts and information, loss of wallet access keys, risk of platform attacks by hackers, risks of price fluctuations. both reduce assets, etc. Each decentralized financial product contains certain risks. Investors need to choose products that suit their goals and research their products before investing.

Where is the Ethereum (ETH) transaction?

Ethereum (ETH) is a popular crypto asset with users. Currently all exchanges list ETH. Includes centralized exchanges and decentralized exchanges. Popular centralized exchanges in Vietnam today:

- Remitano: Allowing beginners to be simple and accessible. Binance, Huobi, OKEx, Kucoin, MXC.com are exchanges for professional investors.

Popular decentralized exchanges today:

- Uniswap, Pancakeswap, Kyber Network,….

Look up information about prices at: coinmarketcap.com, Coinecko.com, blockfolio,,….

Aug 20, 2022

-400-400.webp)