Bitcoin: BTC index analysis, holders please consult before deciding

Listen to this article

We've been in a bear market for a while and it looks like it's going to stop soon. Of course, we cannot forget Bitcoin [BTC], the coin with the largest market capitalization and its price movements affect the entire market, whether it is in an uptrend or downtrend.

BTC price prediction for 2022-2023

The mining industry also had its toughest year in its history, with increasing mining difficulty and declining revenues. However, there are indicators that Bitcoin's value has actually increased over time, suggesting that the recent price action is not a crash.

Bitcoin metrics are a bit positive

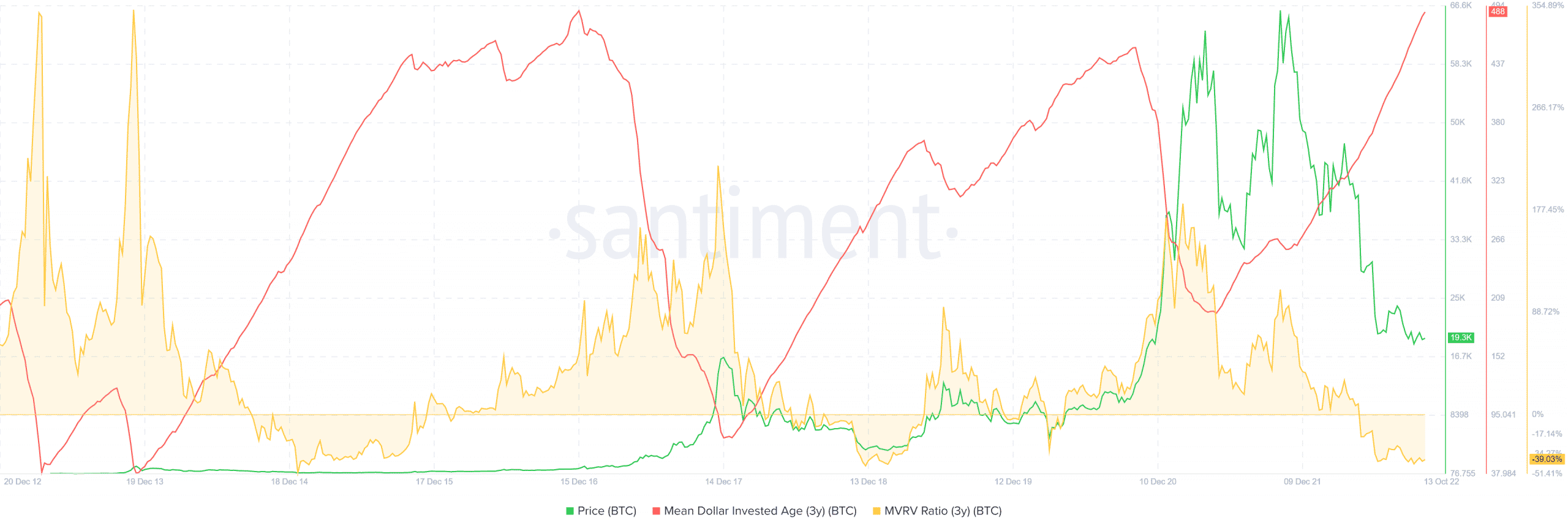

Using data provided by Santiment, we can see that the US dollar Age of Investment Average has hit an all-time high.

He has found himself at over 66 years old, the highest he has reached in recent years. This means that the distribution of coins will be delayed for quite a while. The MDIA has proven to be a reliable predictor of bull and bear markets when considering historical data.

MDIA increases extremely high in cumulative years like 2017. However, a significant decrease in MDIA is correlated with the subsequent decline in prices. Thus, it is suggested that BTC bought at a premium is being returned to exchanges.

Furthermore, looking at BTC supply distribution statistics shows that there were more people holding 1,000 to 10,000 BTC in October than there were in January of this year.

A review of distribution statistics also revealed that from January to date, more than 13,000 holders have consistently held between 100 and 1,000 BTC.

BTC drops to 73%

Examining the BTC price trend since November 2021, it is clear that the price has dropped, as expected.

It is down more than 72% since November 2021, when it was about $67,000. Although it has been tested a few times, as you can see in the chart; Trend lines also act as resistance.

Over 900% growth in BTC price has been seen from the $9,000 range to the $56,000 range it was trading in April 2021. The emphasis on the price range is important because Historically, it has been shown that the percentage by which it can increase can be over 1,000 while the percentage by which it can decrease should not be greater than 100.

The outlook on BTC price movement could be bleak given the overall market mood.

However, a look at some of the key indicators and past price swings shows that BTC has held up pretty well.

The good performance of BTC can even be seen more clearly when taking into account the current state of the global economy and the lackluster performance of fiats.

Oct 19, 2022

Skyrockets by More Than 58 This Week Amid New Binance Perpetual Contract Listing-400-400.webp)

Will Shatter Both Silver and Golds Market Cap, According to Crypto Analyst – Here His Timeline-400-400.webp)