Binance: How will BNB perform next time let's analyze and predict

Listen to this article

BNB recently

- The BNB chain became quite hot due to many active developments

- BNB stochastic is oversold, but all other indicators are negative

BNB's performance last week was not what investors expected. Its price has dropped significantly, like most other cryptocurrencies on the market. The credit for this discount goes to the current market, which benefits the seller.

According to CoinMarketCap, BNB has dropped 19% in the past week. At press time, it is trading at $284.02, with a market capitalization of $45.49 billion.

Even so, BNB, in a recent tweet, stated:

"Whatever happens, one thing you can count on is that our October Stars continue to make solid progress."

According to the tweet, there have been some positive developments on the BNB chain that look quite promising for blockchain. For example, the Boba Network has been nominated for the AIBC Summit 2022 blockchain award, while the Pyth Network is set to launch a CAKE/USD price feed. Additionally, Quest3 has over 18,000 weekly active users on the BNB chain.

BNB was also on CoinGecko's top-rated coins on November 12, which is positive news for the coin.

What is worth of BNB?

Before speculating that these updates could have a positive impact on the BNB price, let's take a look at the BNB indicators to better understand the scenario. At the time of this writing, BNB posted a rally as its price increased by more than 3% in the past 24 hours. However, on-chain indices are still not in favor of investors.

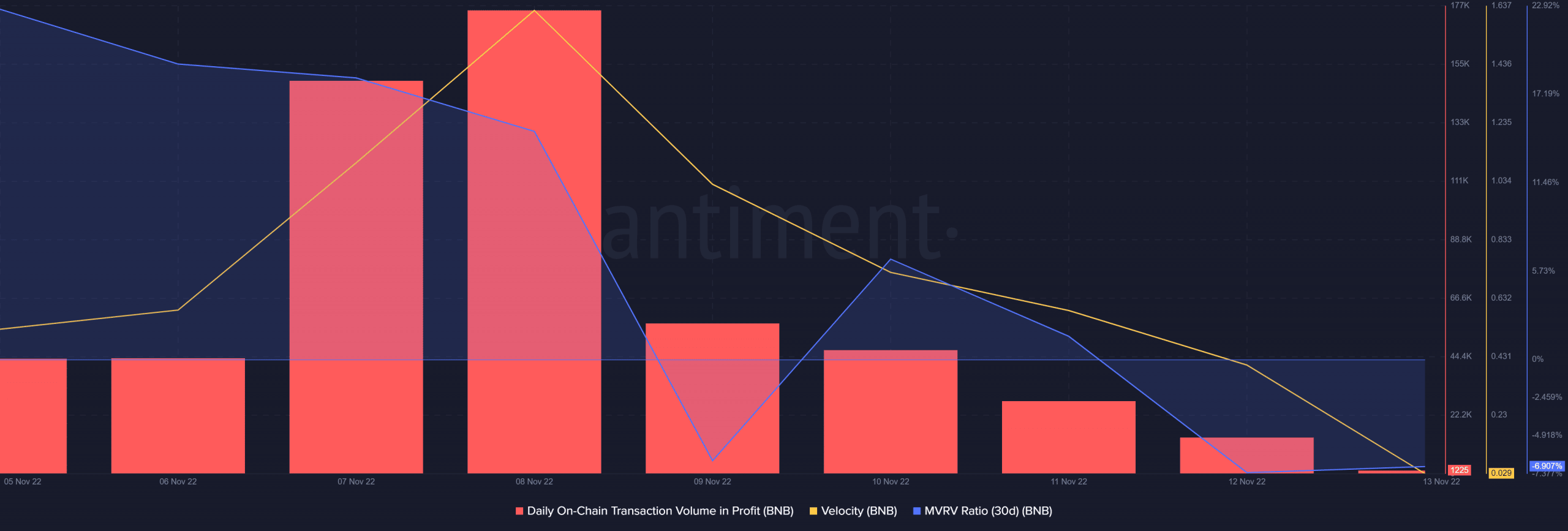

Daily BNB trading profits plummeted after the November 8 spike. Velocity also followed the same path and fell over the past few days, which is another bearish sign. In addition, BNB's market-to-real value (MVRV) ratio has also decreased, adding to the potential for a price drop.

However, data from CryptoQuant gave investors a small glimmer of hope as it revealed a major bullish sign. BNB Stochastic is in an oversold condition, thus acknowledging the possibility of a breakout northward soon.

BNB analysis

The market indicators for BNB painted a bearish picture as they supported sellers. The BNB Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are below neutral, a negative sign for the blockchain. The moving average convergence divergence (MACD) also shows a bearish crossover, increasing the chances of a downside.

The ribbon exponential moving average (EMA) is in favor of the bulls as the 20-day EMA is above the 55-day EMA. However, the gap between them continues to narrow, which could cause an early bearish crossover.

Nov 14, 2022

Skyrockets by More Than 58 This Week Amid New Binance Perpetual Contract Listing-400-400.webp)

-400-400.webp)