CME follows in the footsteps of FTX, registers to open futures trading directly

CME Group, which once criticized FTX when it opened futures trading on its own platform, is launching a similar move.

Listen to this article

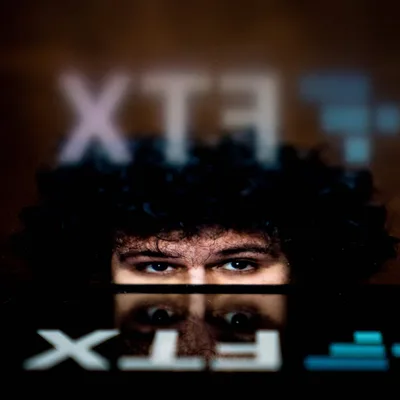

CME Group is said to be following in the footsteps of FTX – the exchange of billionaire Sam Bankman-Fried, preparing to offer derivatives trading directly to users.

CME Group, the world's largest derivatives exchange, has filed to register as a futures commission seller (FCM) - a concept that was proposed by the owner of the FTX exchange during a visit to the White House in May. , The Wall Street Journal reported.

If the above plan is approved by the regulators, investors will be able to trade crypto derivatives directly through the CME instead of needing third-party brokers like TDAmeritrade.

However, it is worth noting that CME has once voiced opposition to a similar proposal by FTX. During a hearing before Congress in May, CME Group CEO Terence Duffy asserted that FTX US had made "false claims about innovations versus cost-cutting regimes".

Joseph Guinan, CEO of FCM Advantage commented:

“If approved, CME will officially enter the futures brokerage space, a 'game changer' and 'a formidable opponent of all FCMs'. Especially in case CME offers more attractive fees.”

Regarding FCM and risk management, a representative of CME Group said:

“Our commitment to the FCM model and the significant risk management benefits it brings to all industry participants remains unwavering.”

CME is considered as the gateway for large institutions in the United States when they want to penetrate and gain exposure to the crypto market. CME launched its first BTC futures contract in December 2017 and ETH futures contract in February 2021. Towards the beginning of this year, the exchange expanded to offer Micro BTC and Micro ETH contracts. The most recent is the move to launch Bitcoin and Ethereum futures trading in euros at the end of August.

FoxCryptoNews summary

Oct 03, 2022

-400-400.webp)

-400-400.webp)