Ethereum (ETH): Analysis of Growth After the Merge

Ethereum just wrapped up the blockchain industry's most anticipated event in 2022. The merger has generated a lot of buzz, especially in recent weeks, but the entire period has proven unfit. in line with ETH's price action.

ETH has failed to deliver a significant rally despite high expectations prior to the Consolidation event. Historically, cryptocurrencies have rallied in the days leading up to a major upgrade to their native blockchain network.

ETH's leveraged long positions may have something to do with its quiet price action. Initial post-consolidation reports suggest that ETH may be on the verge of a bullish move.

ETH reportedly produced deflationary results following positive Consolidation reports.

The merger at least provided a stronger long-term outlook. This is due to a combination of factors such as deflation features along with better POS encryption points. The reduced supply of ETH will contribute to more value creation for the cryptocurrency, especially if it can secure higher demand.

Unfortunately, bullish expectations so far have not had any impact on ETH's short-term price action. This may be related to the fact that some of the larger whale species are holding back prices.

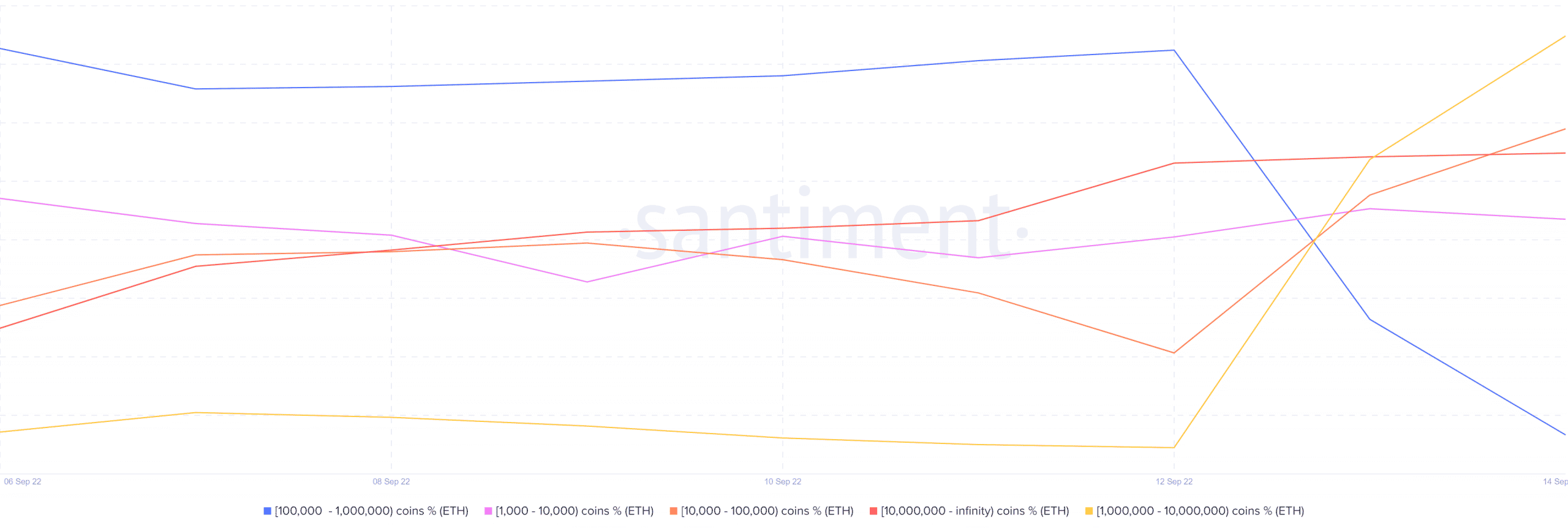

The largest ETH whale (addresses with over 100,000 coins) currently holds the majority of the cryptocurrency in circulation.

However, the same group has been selling its shares since September 12. Thus, it contributes to the prevailing selling pressure.

Meanwhile, other whale portfolios were all bullish over the same three-day period, but their impact was limited.

Is ETH demand on the cusp of a recovery?

Ethereum has recorded a net increase in the number of new addresses since September 4. This reflects positive expectations prior to the Merger, although the buying volume was not enough to offset the selling pressure.

The number of addresses with more than 1,000 ETH has also increased over the past 10 days. It reflects buying pressure from some whales and could be a sign that ETH demand is slowly increasing. This level of demand will create strong momentum if whales brake hard to cut their balance.

There are still some concerns about Fusion despite the successful results. One of those concerns is the decentralization of the participating group. Over 55% of the total ETH supply is currently held by four major holders, including LIDO.

Well, concerns arise regarding the centralized nature of some of these entities and the potential risks involved. However, the new Ethereum PoS is going through its infancy and is expected to become more decentralized over time.

Sep 16, 2022

-400-400.webp)