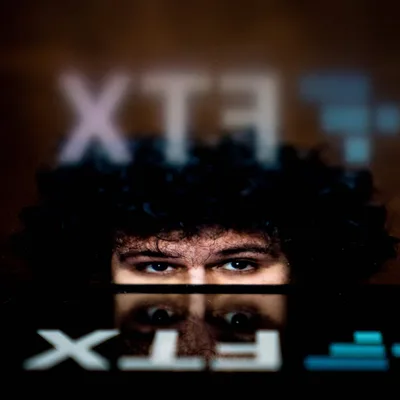

Revealing the cause of the "collapse" of Alameda – FTX

This year, the investment fund Alameda Research has witnessed a series of "failures" in lending decisions, forcing the FTX exchange to intervene to rescue.

Listen to this article

As of June 2022, Alameda Research is said to have a $500 million loan agreement with Voyager Digital, the crypto lending company that declared bankruptcy in July 2022, and this is where it started. chain effect is currently listed on the FTX exchange, according to a source from Reuters . Alameda and FTX have long been known to have a "close" relationship when both founded and run by billionaire Sam Bankman-Fried, although always claiming to be two independent entities.

Tracing history, Voyager is one of the names directly affected by the bankruptcy of the investment fund Three Arrows Capital. It all started with the liquidity crisis in the cryptocurrency market after the LUNA-UST crash in May 2022. At this time, Voyager lent a large amount of money to Three Arrows Capital from users and did not respond in time, leading to inability to pay its debt obligations.

A Reuters source confirmed Alameda Research was one of the names affected by the subsequent liquidity crisis as Voyager went bankrupt, and other major crypto institutions were also stuck with money. However, it is not possible to determine the full extent of the damage that Alameda suffered.

Despite holding $15 billion in assets, Alameda was still in such poverty that FTX CEO Sam Bankman-Fried had to bail out. Sam managed to transfer at least $4 billion of FTX to Alameda . In return, Alameda Research will collateralize the loan with its own FTT token and a 7.6% stake on the Robinhood exchange.

It is worth mentioning that part of this $4 billion is in customer deposits . Although the exact amount is not determined, it is reported that Bankman-Fried did not tell other FTX leaders about the step to support Alameda.

Not stopping there, on November 2, CoinDesk released details of a leaked balance sheet showing that the majority of Alameda's $14.6 billion assets are FTT tokens. Alameda CEO Caroline Ellison tweeted in response that the balance sheet was "incomplete," with the fund still having $10 billion in unrecorded assets.

However, this has raised concerns about Alameda's financial health. As a consequence, Binance CEO CZ announced the sale of all FTT holdings since "the truth is gradually coming to light". FTX was then massively "bank-run" by users and forced to block withdrawals, ending the month with Sam's title of "billionaire" when his fortune "evaporated" $14.6 billion in just one day. one night , and a series of gloomy events surrounding FTX begins here.

On the afternoon of November 10, internal messages between FTX CEO Sam Bankman-Fried and his staff were leaked, revealing that the exchange will put all its efforts into one last fundraising to revive everything. next week. FTX was previously canceled by Binance, and is now said to be looking to Justin Sun. There are other sources that the loss of FTX – Alameda is up to 8 billion USD, as the main reason for Binance to turn away.

FoxCryptoNews summary

Nov 10, 2022

-400-400.webp)

-400-400.webp)