What is Liquidity? Why invest in high liquidity coin?

What is liquidity? What is the importance of Liquidity? Why invest in highly liquid coins? Find out now!!!

In this article, I will go with you to learn about an issue that is always most interested by traders, investors and exchanges in the current cryptocurrency market. That is Liquidity.

What is Liquidity? What factors affect Liquidity? How to check the liquidity of a coin? All are answered in today's article.

Let's start the article together!

What is Liquidity?

Liquidity, also known as liquidity, is the buying and selling of large amounts of a cryptocurrency with no (or very little) impact on the price of that cryptocurrency.

Liquidity is not only used in the Crypto market, but also in stocks, or in any trading asset. An asset is considered highly liquid when it can be sold quickly without the price falling significantly compared to intended, for example BTC, ETH, etc.

Liquidity example

For example, a highly liquid asset in real life, that is gold , you can buy and sell gold anywhere, not exactly a gold shop. The reason gold has high liquidity is because of its preciousness, high acceptability by people.

Another example is cash . If you notice, we always "trade" money every day, exchanging it for other things. Therefore, cash is an extremely liquid asset.

Some assets are illiquid, or very illiquid, such as real estate, antiques, furniture, art pictures, etc.

The essence of liquidity

As I said, the essence of liquidity is the trade-off between the speed of trading and the price at which it can be bought and sold.

- With a coin with good liquidity, this trade-off will be very low. This means that, when you make a quick buy or sell with a large volume, the price of that coin will not be affected much.

- Conversely, this trade-off will be higher for coins with illiquidity.

Let me give you an example for your understanding:

You buy coin A for $1 in volume of $100,000 and after a month coin A is worth $10. At this point, your assets have made a profit of 10 times, or $ 1M.

However, the buying volume at $10 is very small, only $100,000 and the price range of $10 to $9 will have enough volume for $1M.

If you want to take profits immediately, you will have to trade 10% of your profit to sell for $9. In return, you will shorten the waiting time to sell all that amount of A, almost immediately.

The importance of Liquidity

Liquidity is always a very important issue and is always considered very carefully by investors before investing in any market. Especially, in an emerging market like cryptocurrencies, liquidity is always a headache for many investors with large capital who want to enter the market.

Since liquidity affects the price , there is a difference between the expected return and the actual return of that cryptocurrency.

Suppose, you are holding a large number of tokens B and are making 30% profit. Now, you want to sell B token quickly to get 30% of that profit. But unfortunately, token B is having very poor liquidity. If you accept liquidity, you will lose about 50% of the value ie from 30% profit, you will lose 35%.

In case you want to sell but still keep 30% profit, it will take more time to sell at that price. However, the market is not only trading brothers. If you don't sell, someone else will accept to sell and make the price drop very quickly.

Therefore, choosing a coin with high liquidity is always a safe choice for large capital investors.

You can learn more about the properties of coins/tokens in the cryptocurrency market right through the article below.

03 factors affecting liquidity

Popularity of the project

This factor shows that the community's interest in the coin is more or less. Usually, the more popular a coin is, the more people trade it.

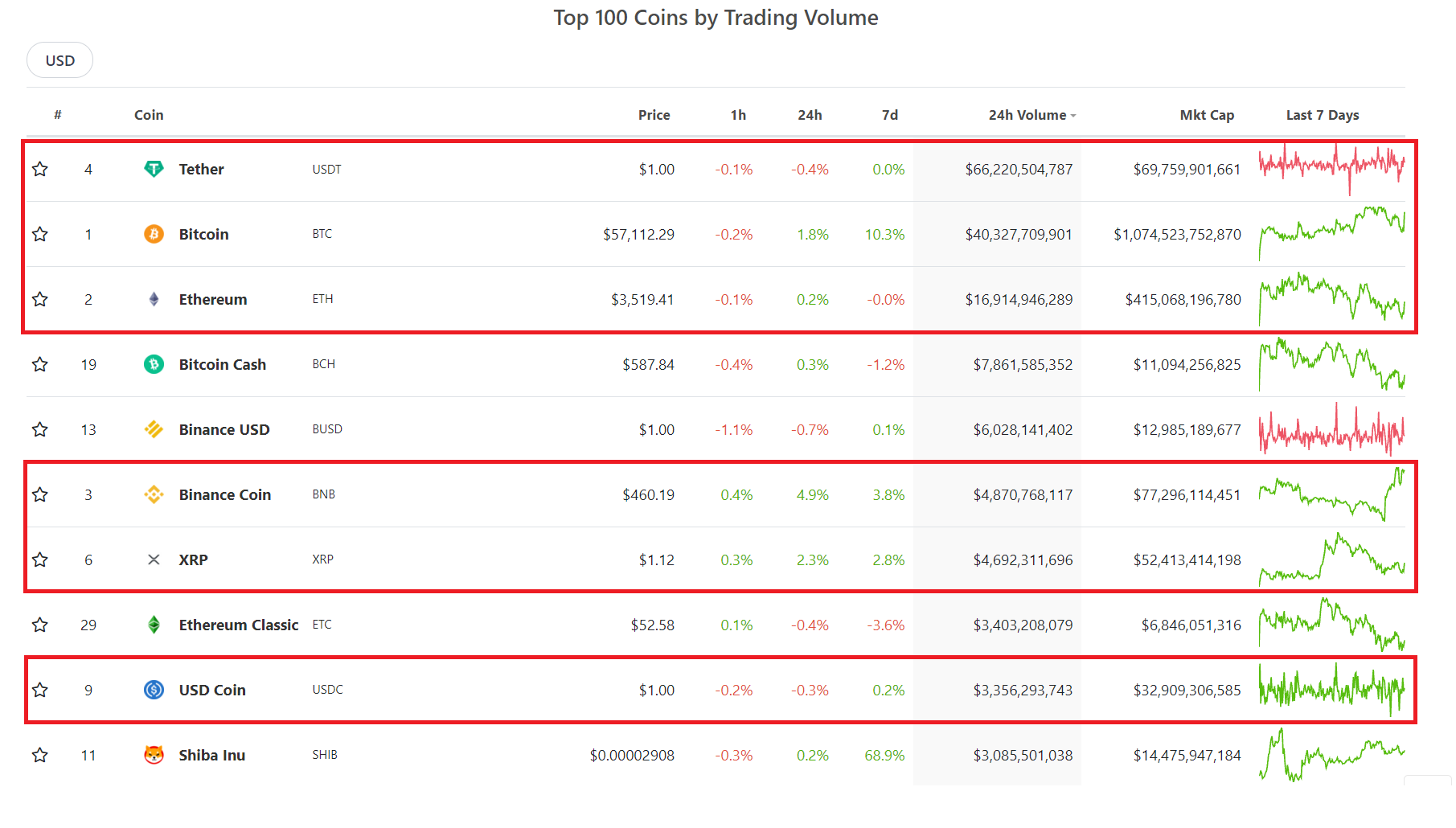

For example, with the current top 10 coins with the largest market capitalization, 5 out of 10 coins are also in the top 10 with the largest trading volume in 24 hours.

Top 10 coins with the highest trading volume in 24 hours. Source: Coinecko

Community hype

In fact, this factor also indicates some interest from investors as above, but sometimes it will be in unpopular assets.

I take an example: Before, no one knew about SHIB (Shiba's token), but since DOGE was FOMO, SHIB is the next token that many people trade. Sometimes it even reached the top 10 coins with the largest daily trading volume.

Reputation of the project

Not all reputable projects have high liquidity, but for the most part, projects with great prestige will also have abundant liquidity.

This is quite understandable, because if a project works seriously, the community will also pay more attention to them.

How to check the liquidity of coins

From the above examples, you also clearly understand that liquidity is a factor that has a great influence on trading decisions. Because it shows how easy it is to buy/sell, get in/out of any coin.

So before deciding to trade a certain coin, you need to check the liquidity of that coin by checking the following 3 factors:

- Trading volume for 24 hours.

- Order Book Depth.

- The difference between the bid-ask price.

Trading volume in 24 hours

Trading volume shows the liquidity of the market and data on past trading volume. This is also an information for predicting future price behavior.

You can use Coinmarketcap, CoinGecko or FoxCryptoNews Market to check the trading volume within the last 24 hours of the coin you want to trade.

Remember that this is the total trading volume , so you have to see which coin is being traded the most, and whether that exchange is in fake volume or wash trading. If you are in this category, it is very difficult for you to trade quickly because most of them are trading bots.

Order Book Depth

After choosing an exchange with a real trading volume, you must check the depth of the Order Book on the exchange of that coin.

This helps to estimate the liquidity if trading instantly with the desired volume.

For example: You want to sell 100,000 VND A at the price of $0.1 and Buy Order Book Depth of coin A shows that:

- At the price of $0.1 there is only $40,000 of A.

- At $0.09 there's another 60,000 A.

From there, you can estimate the difference if you trade off liquidity with transaction speed.

Bid-Ask Spread

The Bid-Ask Spread represents the difference between the most recent buy and sell orders shown in the order book. If the Bid-Ask Spread is higher, the liquidity of that coin is very low and vice versa.

Example: Here is the Bid-Ask price of DOGE/PAX coin on Binance. You can see that the nearest buy order of DOGE is 0.0025293 PAX and the nearest sell order is 0.0026798 PAX.

So if you execute a buy order DOGE, you buy at 0.0026798 PAX and can only sell at 0.0025293 PAX. Thus, you have lost ~6%.

What is Liqiduity Pool and Liquidity Mining?

These are new concepts, unique to Crypto, and starting around the end of 2020, when DeFi was born.

Liquidity Pool refers to the liquidity "pools" of AMM exchanges, or Lending projects, where users deposit assets as liquidity for others to trade. And to encourage users to deposit assets, projects will have incentives such as deducting a part of the transaction fee for them, giving more project tokens to users providing liquidity, etc.

That action is called Liquidity Mining, or incentive programs that provide liquidity. The purpose of Liquidity Mining is to attract more liquidity to AMM, so that large value transactions do not slip much; or if it is a Lending project, encourage users to participate in borrowing.

Should invest in coins with high or low liquidity?

If you invest a large amount of money, it is best to choose a project with high liquidity, because it will not deviate too much. Imagine, you buy an order that makes the asset price increase by nearly 5%, then there is a high risk of being discharged a lot.

But suppose, the project you see potential but has low liquidity, what to do? There are 2 ways to solve this problem:

- Divide large value orders into many smaller orders, you can buy while looking at the price of the coin, whether to buy continuously or buy a little, wait for the price to decrease and buy more.

- Choose a DEX with high liquidity like SushiSwap, Uniswap, etc.

Reference: What is DEX? Overview of decentralized exchanges

Summary

Liquidity is always an extremely important factor in any market. Without good liquidity that market will be very difficult to develop.

Going back to the current cryptocurrency market, liquidity is still an important issue that hinders many traditional investors who want to jump into this potential market. Going deeper, you can see that many coins currently do not really have good liquidity even though the expected profit margin can be very high.

Hopefully, after reading this article, newcomers to the market will not make the mistake of choosing illiquid coins to trade.

Oct 17, 2022

Price Target on the Table if Ethereum (ETH) Does This Next Bull Cycle-400-400.webp)