Why newly developed Uniswap doesn't change UNI price

Listen to this article

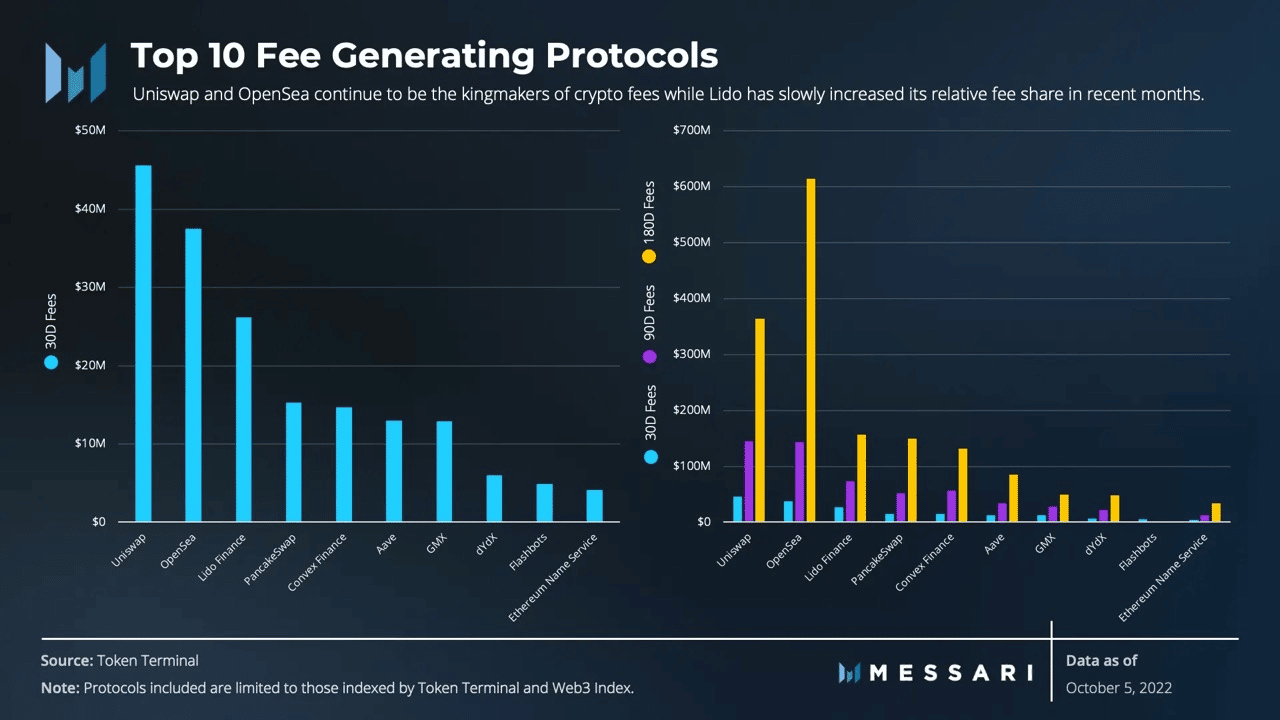

Uniswap [UNI], one of the largest decentralized exchanges, collected the most fees in the past three months. However, the fees collected do not translate into revenue. According to Messari, a cryptographic analysis company, there are other protocols that perform better than UNI in this regard.

UNI price prediction for 2022-2023.

Uniswap factor analysis

Messari, in a tweet posted on October 16, mentioned that although UNI collects a large amount of fees, OpenSea has surpassed UNI in terms of revenue generated in the past three months. As you can see in the image below, despite collecting a large amount of fees, Uniswap did not make the list of the top 10 companies by revenue.

Another worrying factor for Uniswap investors is the drop in user retention. The number of addresses held on the Uniswap network is continuously decreasing.

However, since the beginning of 2022, the number of new addresses added to the network has been observed. The addition of new addresses to the network could have a positive impact on UNI in the near future.

Despite failing to retain users, Uniswap still maintains its numerical dominance over other DEXs. At the time of writing, Uniswap accounts for 67.2% of total DEX volume according to Dune Analytics.

UNI points to improve

Although Uniswap has strength in numbers, there are other areas where Uniswap needs to improve. After looking at the chart below, it can be seen that Uniswap's speed has plummeted over the past few days.

This means that the average number of times a UNI moves from one wallet to another has decreased significantly.

This development, coupled with Uniswap's reduction in market value to real value (MVRV), can be seen as a bearish indicator by potential investors. However, in contrast to Uniswap's shortcomings, the whales continue to show interest in the token.

According to WhaleStats, a crypto whale-watching organization, the top 500 ETH whales held UNIs worth $56 million at press time. One of the reasons for the growing interest from whales could be the Uniswap team's constant effort to develop their protocol. On October 15, Uniswap announced in a tweet that Uniswap v3 will be implemented in zkSync2.0

However, despite all efforts, the price of Uniswap continues to fall.

At press time, Uniswap is trading at $6.13 and is down 0.16% over the past 24 hours. Its volume has dropped by 47.49% and its market capitalization has also dropped by 1.80% in the same time period.

Oct 17, 2022

Spot Exchange-Traded Fund Approvals, Delays Decisions Until October-400-400.webp)

-400-400.webp)

-400-400.webp)