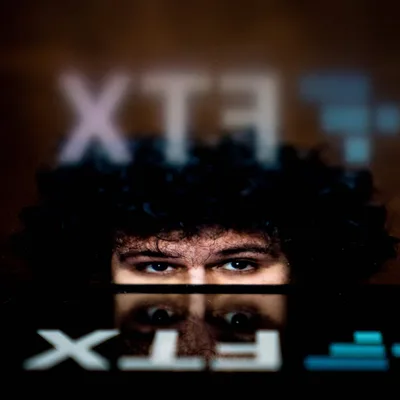

FTX Ventures acquires 30% stake in SkyBridge Capital

FTX Ventures, the investment arm of billionaire Sam Bankman-Fried's FTX exchange, will hold a 30% stake in SkyBridge Capital.

According toCNBC, FTX has acquired a 30% stake in SkyBridge Capital led by Anthony Scaramucci. But the value of the deal has been kept secret and SkyBridge will set aside $40 million to buy crypto as a long-term investment.

According to the press release, the investment by FTX Ventures will also provide additional working capital to SkyBridge for growth initiatives and new product launches.

This is the latest in a series of collaborations between the two companies. Previously, they signed a multi-year partnership to sponsor the global SALT conference and Crypto Bahamas.

SkyBridge is managing about $2.5 billion, including more than $800 million in digital assets, as of June 30, according to the company's website. SkyBridge Founder and Managing Partner Anthony Scaramucci said: “There is a small universe of outside investors that SkyBridge has considered working with and @SBF_FTX is one of them. This will not significantly affect our day-to-day business operations and does not change our strategy. We will remain a diversified asset management company, in addition to investing in blockchain.”

Bankman-Fried also expressed:

“We have worked together for the past year. […] We're really excited about what they've been doing […]from an investment perspective, growing the digital and traditional asset community. From there, we see a huge opportunity for both businesses, especially in crypto and other promising investments.”

Founded in 2005, SkyBridge started investing in Bitcoin (BTC) in 2020 and Scaramucci has been a strong crypto believer ever since. Against the backdrop of the gloomy market in July, SkyBridge has announced the suspension of withdrawals from the Legion Strategies fund - which has exposure to FTX. However, the company still frankly stated that it is not affected by the current crisis. In March, it was reported that the company was planning to launch a Web3 development fund.

Prior to SkyBridge Capital, billionaire Bankman-Fried companies have been involved in a flurry of M&A deals since the start of the crypto winter. Bankman-Fried acquired a 7.6% stake in Robinhood in May. FTX US extended a $400 million revolving line of credit to BlockFi and FTX offered to buy back some of the debt of Voyager Digital, the platform. lending declared bankruptcy in July.

Fox Crypto News Summary

Sep 10, 2022

-400-400.webp)