What is Proof of Reserves? This is likely to become the criterion for choosing a reputable exchange

As users began to panic and gradually lose confidence in the crypto market when the FTX exchange collapsed, Binance CEO Changpeng Zhao made a request for Proof of Reserves to strengthen confidence in the crypto market. So what is Proof of Reserves? Is this likely to become a criterion to choose a reputable exchange in the future? Let's learn about Proof of Reserves with FoxCryptoNews through the article below!

Listen to this article

Proof of Reserves Overview

What is Proof of Reserves?

Proof of Reserves (PoR), also known as proof of storage is a variant form of audit work used to demonstrate transparency in the operation of companies in the field of custody or exchange. translation in the cryptocurrency market.

The third party will be the party that performs the audit in the Proof of Reserves system by accessing the address representing the total balance of the customer's assets and ensuring that the customer asset is stored in a certain amount. assets equal to (or greater than) the total assets held by all clients for the purpose of creating sufficient liquidity for all client withdrawals.

However, with the development and adoption of blockchain technology in the cryptocurrency market, the implementation of Proof of Reserves is verifiable on-chain and verifiable by anyone. So, in practice, an exchange or any depository institution can present “Financial Statements” in an on-chain form. This way, the user or any interested 3rd party can verify the institution's data that they actually hold specific types of assets that match the account balances, and still does not reveal the user's identity.

Thus, Proof of Reserves presents an overview of the liquidity of an institution or an exchange in order to minimize the impact of events such as “Bank run” as well as provide transparency about source of money, building trust for users.

Proof of Reserves Auditing Model

Operating model

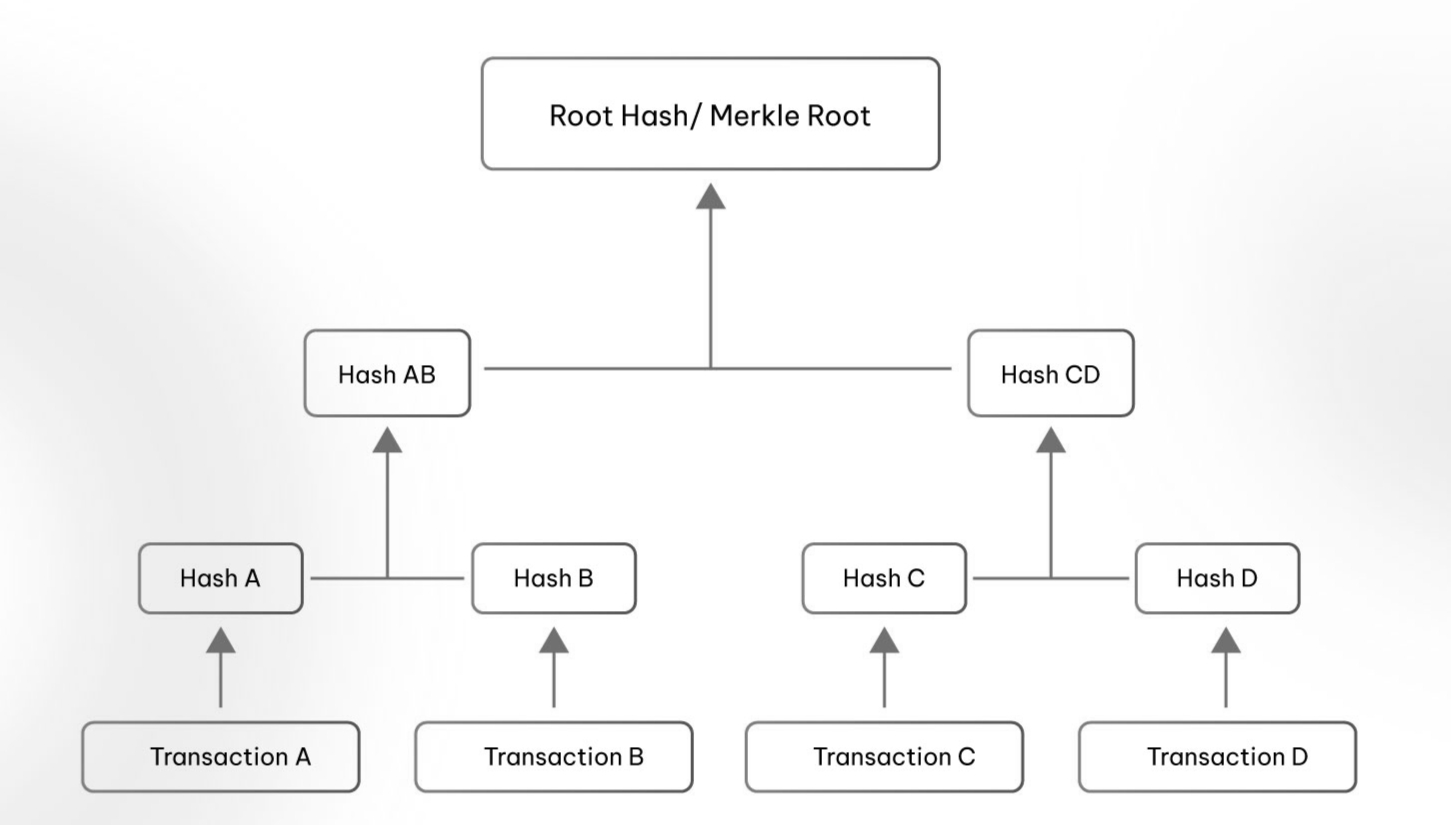

The Proof of Reserves model uses a secure data structure called a “ Merkle tree ” (or “ Hash tree ”). This model can aggregate the total asset balance of all customers without revealing any personal information.

All aggregated data is queryable through the Merkle Root. This is a tamper-proof fingerprint-password-like mechanism that auditors can access to verify balance information. Using the Merkle Tree mechanism as the foundation for blockchain technology will help keep it safe and protect data from any tampering or hacking.

Merkle Tree is a data structure used in computer science applications. In the blockchain industry, Merkle Tree is used to encrypt block data and increase efficiency, security, verifiability, and reduce difficulty in querying blockchain data.

Example: According to the above model, we have transactions A, B, C, and D. Each transaction will be hashed and become Hashes like: Hash A, Hash B, Hash C, and Hash D. Then, Hash pairs that will be consecutive and close together will be linked into a summary form of that Hash pair such as Hash AB and Hash CD.

And continue, the Merkle Tree of the block will continue to be formed by combining the two functions Hash AB and CD into Hash ABCD. This process will loop continuously until there is only one Hash left and we call it Merkle Root or Root Hash.

The Merkle Root will summarize all data in all related transactions, store it on the block, and maintain the integrity of the data. If a single detail in any transaction or transaction order changes in a Merkle Root transaction , all the data will also be affected and the final result will be modified, of course. Changing data will make history so it can be checked out.

Thus, with Merkle Tree, a 3rd party can access and retrieve Merkle Root from the provider to analyze and verify the data to prove that the reported balance of the exchange or organization is at least correct. equals the balance obtained from the Merkle Tree.

Because, as mentioned above, changes to an investor's balance are easily detected on the Merkle Tree and make a drastic change in the data structure. Through this, organizations will not be able to tamper with users' balances without being detected.

The Challenge of Proof of Reserves

While Proof of Reserves ensures that a company in the cryptocurrency market has assets available to cover its liabilities, it is a single snapshot in time, not an accounting of real-time balances.

In addition, it also only shows the on-chain assets of the custodian but does not track the origin of those assets (i.e. whether the assets were borrowed for audit purposes).

So, Proof of Reserves can only tell the solvency of a company in the crypto industry according to on-chain data, but there are ways to avoid checking from on-chain data such as: debts off-chain or colluding with the audit team.

Chances of Proof of Reserves

The goal of the Proof of Reserves offering is to bring financial transparency from a cryptocurrency company's balance sheet, especially in regards to customer cash flow.

Third-party audits give consumers confidence that the crypto company they are using has enough liquidity to handle day-to-day operations and, more importantly, customer withdrawals.

So, from the challenges, the opportunity to develop an audit niche in the crypto market is a possibility and has a significant impact on the entire cryptocurrency market in the future.

Effect of Proof of Reserves on the Crypto Market

For users

Because of the convenience of Proof of Reserves, users or customers can automatically check and verify assets held by crypto companies. Also thanks to this, users can track how the cash flow of organizations works for a more comprehensive and objective view.

Besides, from looking at the cash flow and operation method of the exchange or custody platform, users can make an objective assessment of the reliability of that exchange or custody platform to can make decisions about trusting and experiencing the products offered by the service provider.

For exchanges

Provide a means to regain and maintain user trust

Because of the collapse of the FTX empire, it made crypto investors panic and panic when a 2nd exchange in the market collapsed so quickly. And the cause, you can refer to this article: Revealing the cause of the "collapse" of Alameda – FTX – FoxCryptoNews

Therefore, to strengthen the trust of users, the CEO of Binance called on exchanges to provide proof of customer deposits.

This can be seen as a form of statement in the crypto market. Everything is transparent, user trust remains.

Summary

Although there are many limitations to using on-chain data only in the basis of evaluating the performance of any exchange or custodian through Proof of Reserves, however, this could go a long way in demonstrating transparency in the use of funds by any custodial firm in the crypto market.

With Proof of Reserves, the crypto market can build trust with new users and expand the audit niche to enrich the market. In addition, in the future, perhaps Proof of Reserves will be a top criterion for users to decide to use or invest in which crypto exchanges, custody products or projects.

Nov 25, 2022

Skyrockets by More Than 58 This Week Amid New Binance Perpetual Contract Listing-400-400.webp)

-400-400.webp)