Continually many organizations declare "solidarity" from FTX

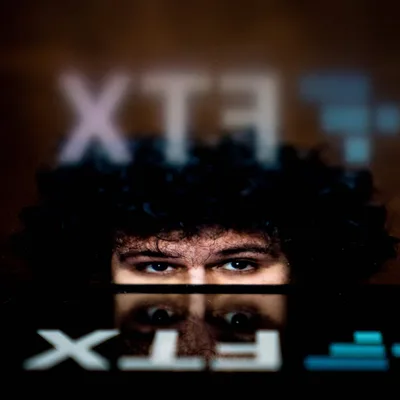

In the last night and early this morning, there have appeared more "contact clues" between some big men and the "seismic" named FTX.

Listen to this article

Wintermute has money on the floor, but not much

Cryptocurrency market maker Wintermute has funds trapped on the FTX exchange that are insignificant and take on risks, the company said.

Wintermute has no exposure to FTT: “As a market-neutral company, we do not have any exposure to FTT tokens or related ecosystem assets.”

“We have funds on FTX, but this amount is within our risk tolerance and is unlikely to have a significant impact on our overall financial position.”

Amber Group "immune", stuck 10% of trading funds

Also yesterday, Amber Group confirmed that it is not exposed to Alameda or FTT, but has actively participated in transactions and has about 10% of the total trading capital being "strapped" on the floor.

“While we have significantly reduced our exposure over the past week, there are still pending withdrawals. However, this does not pose a major threat to our business or our liquidity.”

Solana "safe and unharmed"

According to Solana co-founder Anatoly Yakovenko, Solana has no assets on FTX and is therefore unaffected by ongoing events. This person also confirmed that the company behind Solana still has enough money to operate for the next 30 months.

Chain Protocol puts trust “in the wrong place”

About 1 hour ago, the CEO of Chain Protocol spoke up and reassured the community.

Narrating what the CEO provided, Alameda used to be the main market maker of XCN , however Chain has terminated its relationship with them since this summer, due to unusual market movements. Chain has revoked the loan and stopped cooperating with Alameda.

However, Chain continues to use FTX for OTC and trading. Even, Chain continued to trade here right after the tweet committed to still have enough money of the owner of the FTX exchange. The project believed that statement and left the money on the exchange, an 8-figure amount stuck and waiting to be withdrawn.

As of 2020, when Chain was acquired by Stellar/Lightyear, having sold any treasury tokens, “we are actually net positive since inception.”

Chain insists there is still a large treasury to operate. But it sucks anyway, because they put their trust in FTX and SBF.

“Our deposit and recent transactions were misplaced after he pledged to keep his assets on the exchange safe.”

In conclusion, the project will entrust the above incident to lawyers and is looking to raise funds for Chain and continue to build and implement strategic changes for the long way to come.

Sequoria "lost"

Sequoia Capital investment fund accepted to lose $213.5 million invested in FTX. In a statement posted on the morning of November 10, Sequoia Capital said that because of the recent events with FTX and because the full nature of the case is not known, Sequoia will record the value of its investment in FTX at zero. .

Sequoia further revealed that its Global Growth Fund III has invested $150 million in FTX and FTX US, while the SCGE Fund has invested $63.5 million. These investments are made in 2021.

Coinbase Ventures decided to “float”

The big giant Coinbase also spoke up , accepting "zero" on the investment in FTX, claiming "to lose nothing but not affect business operations.

“We have invested equity in FTX and do not hold any FTT. With venture capital, there is always the possibility of the investment going to zero. In the case of FTX, doing so will not affect Coinbase operations.”

Last night, as Cointelegraph reported, "giant" Galaxy Digital also revealed that it had exposure to $ 76.8 million in assets with FTX and Multicoin Capital was being "detained" by 10% of the above assets.

The above disclosures were announced as industry players including Tether, Circle, Coinbase, etc. are looking to appease public opinion and reassure the community, after FTX announced plans to "sell itself" to Binance for liquidity crisis. However, recently, Binance announced its withdrawal from the repurchase agreement, "FTX is incurable", the market continues to be engulfed in flames and is expected to get worse.

——————————————

Synthesis of Binance – FTX drama

– Binance liquidates its entire investment of 580 million USD in FTX tokens

– Users massively withdraw from FTX

– The whole market dumped strongly, FTT lost 22 USD

– Binance reached an agreement to buy back FTX

- FTX CEO's assets decreased by 14.6 billion USD, wrote a letter to apologize to investors

– CZ urges exchanges to provide proof of customer deposit

– The Solana system “bears the battle”

– Binance cancels the acquisition of FTX

Nov 10, 2022

-400-400.webp)

-400-400.webp)