Dogecoin:Elon Musk twit and DOGE coin action analysis

Listen to this article

As the rest of the market corrected over the past 24 hours, the leading meme coin Dogecoin [DOGE] also increased significantly. Following reports that Elon Musk's acquisition of social media giant Twitter will complete on October 28, the price of the Elon-backed token has increased since then.

According to data from the on-chain analytics platform Santiment, during intraday trading on October 26, DOGE's price rose above $0.0722 for the first time in ten weeks.

However, during its rally, DOGE changed hands at $0.07765 at press time, having gained 17% in the past 24 hours, according to data from CoinMarketCap.

In addition to its price spike, DOGE's trading volume and the number of whale trades made on the network on October 26 also increased. According to Santiment, these have risen to levels last seen in August.

More than 451 DOGE whale transactions in excess of $101,000 were completed by 23:15 UTC on October 26. At the time of this writing, the number is 200.

Additionally, DOGE intraday trading volume peaked at $1.181 billion in trading yesterday. At press time, this stands at $1.72 billion, up 171% over the past 24 hours, according to CoinMarketCap.

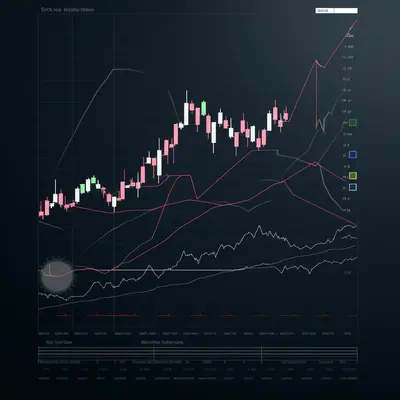

DOG Price chart analysis

While the rally may have provided some much-needed respite for long-term holders, DOGE's price movement on the daily chart has sent warning signs. Key indicators suggest that the meme is overbought at press time, with a correction expected.

The DOGE Relative Strength Index (RSI) is seen away from the neutral point in the overbought zone of 79. The indicator's rise from 44.82 (below midpoint) on October 24 to 79 (deep of the midpoint) overbought zone) shows a spike in Buying Pressure in recent days. Such highs are often followed by exhausted buyers and unable to hold, hence a reversal.

Following a similar path, DOGE's Money Flow Index (MFI) is pegged at 85 at press time. Between October 24 and press time, the value of the indicator has increased from 45 to its current position. This also shows that the meme is overbought and the bears will soon start to reverse.

Surprisingly, as a result of its protracted decline, DOGE's 1-day moving average market value to exercise value (MVRV) ratio shows that holders are losing money despite the price. get a raise.

At -30.42% at press time, most people would lose if they sold off their holdings at current prices.

Oct 27, 2022

-400-400.webp)