Ethereum: Is ETH trustworthy if big companies dominate staking?

Ethereum has completed the merge event and switched to staking instead of Pos. So whether ethereum is still reliable when the big guys hold a controlling stake, let's find out.

The merging of Ethereum [ETH] with the proof-of-stake (PoS) network was successfully completed on September 15. The meaning of the Merge is that miners are now replaced by validators on the Ethereum network. However, a relatively small number of companies control the PoS mechanism. This has analysts concerned about the centralization of the ETH network.

Lido and Coinbase Dominate Validation

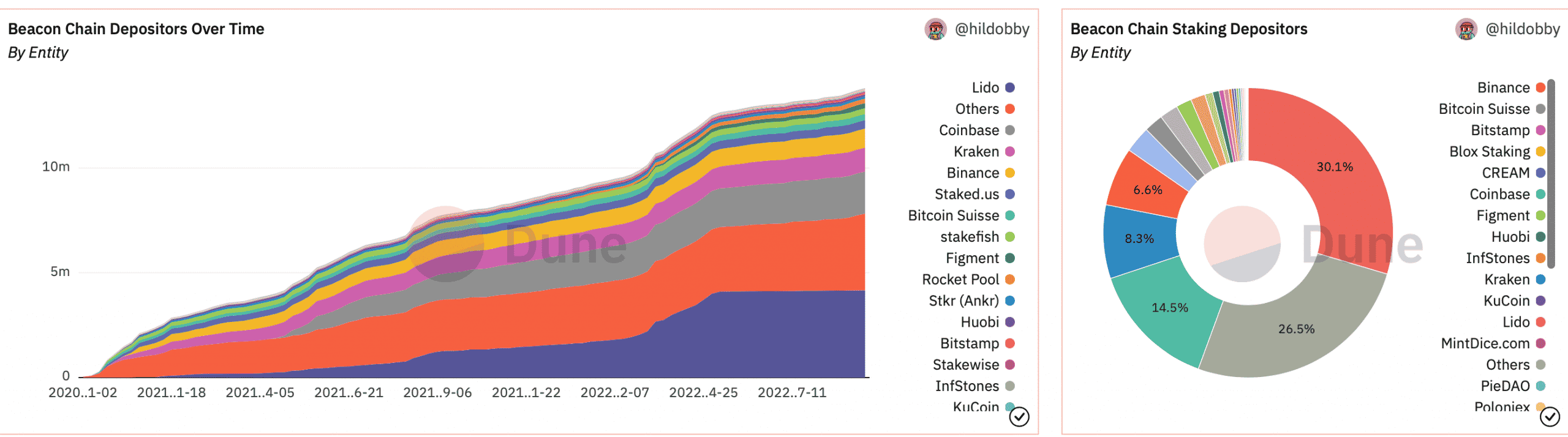

According to a recent study by Dune Analytics, Lido and Coinbase are currently the two highest-stakes ETH holders. At the time of writing, they hold 4.16 million ETH (30.1%) and 3.65 million ETH (14.5%) respectively. The remaining shareholders own a total of 26.5%.

Martin Köppelmann, co-founder of DeFi platform Gnosis, also noted this dominance. He posted a chart showing that Coinbase and Lido have the highest share-based Ethereum validation rates. He also tweeted that it is disappointing to see that the top seven entities own more than two-thirds of the ETH holdings.

Some implications of centralized authentication

The likelihood of a "51% attack" increases if participation in the ETH validation process becomes too centralized. In this case, a bad guy can allow forged transactions and seriously sabotage the network if he can accumulate up to 51% stake.

Additionally, entities with a larger stake in the network may be breached. This can lead to network sabotage. Furthermore, according to data from Chainflow.io, ETH currently ranks low in terms of decentralization. This is a problem on different fronts.

Another implication is that participation in ETH, especially through these key entities, opens up the possibility of asset censorship.

Additionally, SEC Chairman Gary Gensler warned that brokers that allow users to "stake" their cryptocurrency could classify it as a security on the Howey test. He reiterated this view in writing in his testimony before the United States Senate Banking Committee.

As a result of the transition to PoS and the fact that only a few companies own the majority of the shares, Ethereum may have found itself on the SEC cross-list.

Look at the price

The day before the consolidation, ETH put up some good numbers. It opened at $1,577, hitting a high of $1,649 before closing at $1,638, up just over 4%. However, the price fell on the day of the merger. Ethereum closed at $1,472, overcoming a 10% loss at the end of the day.

At the time of publication, the highest value at which it was traded was $1,483. The Relative Strength Index (RSI) dips below 50. This makes it a bearish trend for altcoins. With support at $1,400, ETH struggled to break through the $1,660 resistance. Overall, there has been a downtrend in the price of Ethereum in recent days.

According to data from Coinmarketcap, Ethereum has lost more than 23% in trading volume. Furthermore, the market capitalization has dropped more than 7% in the past 24 hours.

In fact, new data from CoinGlass shows that $288.22 million worth of digital assets have been liquidated in the last 24 hours.

Needless to say, Ethereum led this rally to the south.

Sep 17, 2022

-400-400.webp)