What is DeFi? Overview of investment potential & opportunities in DeFi

What is DeFi? What is DeFi coin? How to choose DeFi coin? Learn about the nature, composition and potential in DeFi now!

"What is DeFi?" is an article FoxCryptoNews team has made since October 2019. Before that article, I and the team had a perception that DeFi would be the next trend of the crypto market. After less than a year, everything was so clear.

The crypto market changes very quickly, even the DeFi trend has a movement of money. So, me & my team have updated the article “What is DeFi?” This is to bring you the latest and most focused knowledge about the current DeFi 2021 trend.

Before continuing to read the content below, some questions I will answer in this article:

- What is DeFi? Compare DeFi 2021, 2020.

- Understand the essence of DeFi.

- Compare DeFi vs CeFi.

- Components of DeFi.

- The potential of DeFi 2021.

- Invest in DeFi 2021 projects.

The knowledge about DeFi is also very much and needs constant updating, in one article, I can't share it all. Therefore, if you want to invest in it, you need to actively learn more deeply.

DeFi and CeFi . Definitions

What is DeFi?

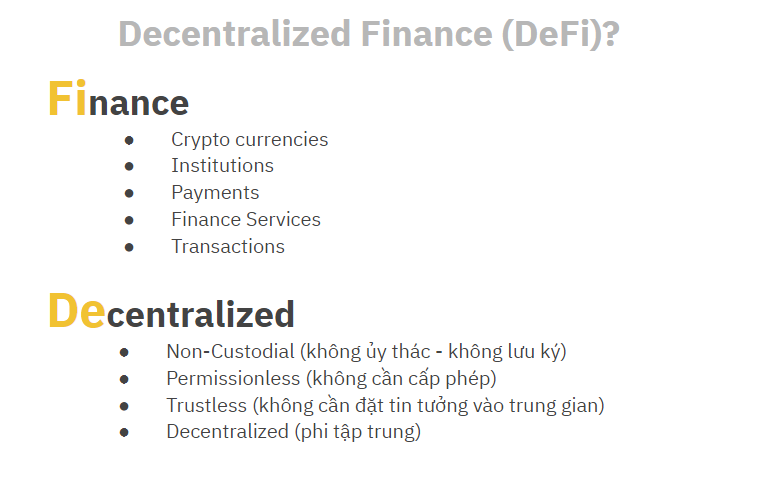

DeFi (Decentralized Finance) is a decentralized finance (or open finance) in which institutions, markets or financial instruments are managed decentralized.

In simpler words, DeFi leverages the power of Blockchain to be decentralized and transparent to create an open financial platform, in which anyone can access and use it anywhere, anytime. which is not subject to the control of individuals or organizations with centralized power.

In DeFi always comes with "Non-Custodial", ie no trust.It is also thanks to this feature of DeFi that we often call it Open Finance or open finance.

Learn more: What is a non-custodial wallet? Why do DeFi players have to own a non-custodial Wallet?

DeFi - Decentralized Finance

Products and projects in DeFi are also fully similar to those of CeFi:

Products and projects in DeFi

In DeFi, there are also operations similar to CeFi. They can be savings, loans, borrowings, transactions, transfer orders, debt, bill payments, etc.

And instead of being processed through an intermediary 3rd party, those operations take place on the blockchain's Smart contract.

What is CeFi?

CeFi (Centralized Finance) is centralized finance, in which components such as institutions, trading markets or instruments are centrally managed .

Contrary to DeFi, CeFi always comes with the phrase "custodial" or trust, ie financial assets, products and services will be entrusted to an organization.

Definition of CeFi - Centralized Finance

Some forms of CeFi in the traditional financial market for you to easily imagine:

Forms of CeFi

In CeFi, all of the above components are active, interacting with each other through a 3rd party. The activities can be savings, loans, borrowings, transactions, transfer orders. , salary debt, bill payment,...

Activities in CeFi

That third party can be a central bank, a government, a financial institution, or a major power. The components above are all very easy to imagine with the examples around us.

Advantages of CeFi:

- Familiar, accessible.

- Protected by laws & institutions.

Cons of CeFi:

- Must go through a 3rd party intermediary.

- High cost.

- Transparency issue.

- Not for everyone.

In crypto, projects belonging to the CeFi group:

CeFi projects in Crypto

- Centralized exchanges: Coinbase, Binance, OKEx, Huobi.

- Forms of lending & Borrowing: Nexo, Celcius, Constant.

- Stablecoins 1.0: USDT, USDC, PAX, HUSD, GUSD.

A huge limitation of traditional finance is the centralization or concentration of power. DeFi is the solution for this.

Differentiate CeFi vs DeFi

The biggest difference between traditional finance and decentralized finance is trustworthiness.

In traditional finance or Traditional Finance: Organizations, markets & financial instruments always exist intermediaries with centralized power. Meanwhile, DeFi leverages Blockchain's power of transparency and decentralization to eliminate these intermediaries. Specifically:

- Governments or banks (CeFi) will be replaced by decentralized blockchains.

- CeFi assets will be replaced by tokens that are in the Blockchain's ecosystem and they are decentralized.

DeFi's mission is to provide access to financial services to users anywhere, anytime as long as they have the Internet ⇒ This represents DeFi's signature openness.

Differentiate DeFi vs CeFi

In fact DeFi has been & is growing very fast, all products and services in CeFi can be replaced by DeFi applications. Below is a table comparing organizations and projects in DeFi vs CeFi (the image below is inspired by the article on Medium):

Compare organizations and projects in DeFi vs CeFi

For me, DeFi is the practical application and makes the most of the power of blockchain (decentralization).

What exactly is DeFi like? I will explain below.

The essence of DeFi

As I mentioned above, DeFi is the most practical application of blockchain. It takes advantage of the advantages of blockchain. Consists of:

- Decentralization.

- Distributed.

- Transparency (Transparent).

You can refer to what Blockchain is to better understand the properties and operation of Blockchain.

Thus, DeFi also inherits the following properties from Blockchain:

Features of DeFi:

- Decentralization - Decentralized.

- Permissionless - Permissionless.

- No need to put trust but still ensure safety - Trustless.

- Transparency - Transparent.

- No need for trust - Self-Custody.

Comparing DeFi vs CeFi above, you will immediately see that DeFi eliminates CeFi's 3rd party intermediaries (get this based on the above-mentioned properties of DeFi).

Blockchain's Smart Contract as a 3rd party in DeFi

The 3rd party in DeFi right now is not organizations, banks, or governments (who can control us) but Blockchain's Smart contract will take over that role.

Components of DeFi

Before you read the important components of DeFi below, I would like to update some of the very clear changes and differentiation of DeFi right now.

- Yearn remained a force in DeFi as Andre began preparing a stablecoin-related project of his own, backed by KP3R.

- The current trend is multi-chain, with many projects creating their own versions of other chains, such as Aave in Polygon, Sushi in Fantom, Polygon.

- The market is running out of ideas, new projects are merely clones of old projects without much creativity.

- IDO (Initial DEX Offering) - decentralized fundraising is slowly dying, proving that the ROI is no longer too high, if not the risk of loss even when buying at Private or Seed Sale prices.

In 2020, DeFi has:

- Lending & Borrowing platform (borrowing & lending platforms).

- DEX (decentralized exchanges).

- Decentralized stablecoins.

- Payment (decentralized forms of payment).

- Derivatives (decentralized derivative projects).

DeFi Ecosystem 2020

However, DeFi in 2021 could not be encapsulated in one picture like the one above, but has evolved differently across many ecosystems. I will go into more detail below.

Decentralized Stablecoins

Stablecoin is a type of cryptocurrency designed with the aim of minimizing the impact of price fluctuations (volatility), by fixing to a more stable asset such as real money (fiat money), commodities (gold, silver…) or maybe another cryptocurrency.

Stablecoins take advantage of blockchain and peer-to-peer value transfer while users are not subject to high volatility like from other cryptocurrencies. As such, stablecoins will be issued in a decentralized manner.

Personally, I will divide Stablecoin into 2 generations:

- Stablecoins 1.0 are stablecoins issued against the collateral of centralized commodities like USD dollar, gold (USDT, USDC, TUSD,..).

- Stablecoins 2.0 (Decentralized Stablecoins) are issued against the collateral of other cryptocurrencies (DeFi). Simply put, you can mortgage your crypto to issue stablecoins (with a smaller amount).

In those Stablecoin 2.0 projects, they usually have a governance token, called a Governance token. This is the token that you can invest.

Some projects that you should know: MakerDAO (MKR), Terra (LUNA), Just (JST), Reserve (RSR), Kava (KAVA), Venus (XVS).

Learn: Stablecoin analysis - "Guideline" of money flow in crypto

Decentralized Lending and Borrowing

This is a decentralized lending & borrowing platform, the two main actors in Lending & Borrowing are:

- Lenders (depositors): Using assets or money to lend to Borrowers at a certain interest rate. After a period of time, they will get back the principal and interest as originally agreed.

- Borrowers (loan taker): Borrow money or property from Lenders and are willing to pay interest on it.

Some notable projects in this segment: AAVE, MakerDAO, Osis, BZRX, Fulcrum, Compound, Dharma.

Learn: Lending Analysis - A premise for the development of DeFi

Decentralized Insurance

Decentralized Insurance is a decentralized form of insurance for users in DeFi applications.

If in traditional insurance, we always have 2 parties:

- The first party is the people who buy insurance , the subjects like me and my brothers.

- The second party is the agent , the insurance seller, the risk analyst as well as will compensate you when the risk occurs.

Then in DeFi we want a decentralized, decentralized way, so insurance in DeFi will be 3 parties:

- Insurance buyers: Those who want to protect themselves from the risks of participating in the crypto space, or DeFi-related products. They will buy relevant insurance and when something goes wrong, they will be compensated according to the contract in the Smart Contract.

- Risk assessors: As people who trust this system, they will pay to insure others. When the buyer spends money to buy insurance, this amount will be divided among those who assess this risk.

- Claims reviewers: People who will assess whether your claim is admissible.

These 3 parties will work together and share risks in the entire decentralized insurance system.

Prominent projects in the Decentralized Insurance segment: Hakka Finance (3F Mutual), Yearn Insurance, Nexus Mutual, Opin.

Decentralized Exchanges (DEX)

DEX (Decentralized Exchange) are cryptocurrency exchanges built and operated in a decentralized manner on the Blockchain platform. DEX allows buying and selling transactions to take place peer-to-peer on the Blockchain network without going through any intermediary organizations.

This group is certainly very familiar to you, as it has been developed since 2017. Up to now, they are also divided into many different types.

Prominent projects in the Decentralized Exchange segment: Sushiswap (SUSHI), Uniswap (UNI), 1Inch, Balancer (BAL), Curve (CRV).

Learn: 05 criteria for choosing a reputable DEX!

Liquidity Mining

Liquidity Mining is a form of allowing users to profit by providing liquidity for their coins to the exchange. In return, participants will receive (usually) governance tokens.

This form is very popular since July 2020 and is often accompanied by the keyword Yield Farming. Briefly explained, Yield Farming is a term that refers to users trying to generate as much profit as possible from their crypto assets, through providing liquidity to DeFi protocols.

Coming to 2021, Yield Farming has not kept the same attraction as in the past, but is still the main form of bootstrapping liquidity. So in this section, I won't show any outstanding projects, because at the moment, this is just a tool, not a unique point.

Decentralized Oracles

Oracle is a system that provides real-time data for blockchains and smart contracts. Thanks to Oracle, blockchain and smart contracts (on-chain) can interact with external data (off-chain).

In other words, Oracle acts as a data source that is sent to smart contracts. Thereby, they are allowed access to actual data that is outside the Blockchain ecosystem. Usually asset price information at an actual point in time.

Oracle projects you should know: Chainlink (LINK), Band Protocol (BAND), DIA, Tellor (TRB).

Decentralized Derivatives

In traditional finance, a derivative (or derivative) is a financial transaction contract between two or more parties, based on the future value of an underlying asset. That is, people will trade on the value of another entity, not directly owning it. Profit is generated based on the spread and price movement of that underlying asset.

In DeFi, Decentralized Derivatives is a form of decentralized derivatives trading based on the value of Crypto coins. Simply put, brothers will trade with each other based on the price of Crypto coins, not directly own and buy and sell those Crypto coins.

As such, the difference between traditional and decentralized derivatives trading is the underlying asset:

- Traditional Derivatives: The underlying asset is a bond, stock, or interest rate.

- Decentralized Derivatives: The underlying assets are cryptocurrencies.

Decentralized derivative products: dYdX, Perpertual Protocol.

Synthetic Assets

Synthetic Asset is a new type of derivative, specifically, tokens that are digital representations of derivatives. Where derivatives are financial contracts that provide customized exposure to the underlying asset or financial position, synthetic assets are a tokenized representation of those positions.

Synthetic assets: Synthetix, Mirror Protocol.

What is DeFi coin? Criteria for choosing potential DeFi coin

DeFi coin is the coin/token of DeFi projects. Some criteria to choose a potential DeFi coin such as:

- Blockchain must be a new version, with good scalability and storage, and high security.

- Funded by reputable funds or investors.

- The project development team is experienced in the crypto market & it is important to understand how the market works. DeFi is currently developing quite similar to the traditional financial market (Trafi). So if a team understands the "money game" in the Trafi market, it will be a big advantage.

- The project is located in the right direction of the current trend. Or if the project does not develop according to the trend, it must develop and build in the essential segment.

- There are products and applications that can meet the needs of users, providing a good user experience.

DeFi Ecosystem Per Blockchain

As mentioned above, DeFi can no longer be summed up by a few projects, but has differentiated specifically in each blockchain, creating different ecosystems.

Prominent ecosystems in 2021 can be mentioned as Solana, BSC, Near, ...

Near . Ecosystem

Solana Ecosystem

The potential of DeFi 2021

When it comes to DeFi, you often hear TVL figures.

TVL (Total Value Locked) is the total amount of assets locked in DeFi applications. The larger this number, the more attractive DeFi is to users.

Figures for November 21, 2020

Data as of 3/7/2021

In just over half a year, DeFi's TVL has grown eightfold. The peak is almost 12 times ($150B).

In which, most of the main contributing projects to TVL are in the DEX and Lending segments. It shows that after a period of development, the arrays that are considered the hottest are currently only DEX and Lending.

The reason may be that users begin to understand more about DeFi, and gradually trust to use decentralized exchanges, as well as become more proficient in increasing capital efficiency by borrowing. .

Will these two segments continue to dominate DeFi, or will the future be the playground for other names in the derivatives, asset management, etc.

The names that are building the DeFi ecosystem

We are mainly individual investors, directly investing in DeFi projects. For large organizations, they are directly involved in the construction of the DeFi project.

Let's see what the big guys have & are doing to build the DeFi ecosystem.

Binance Smart Chain

After a very strong growth, Binance Smart Chain has begun to show signs of "reaching the threshold" when signs such as TVL or BNB price have slowed down.

The FOMO of Binance Smart Chain has caused a lot of “junk” projects to grow like mushrooms, leading to a lot of hacking events. This can be seen as a purge of low-quality projects.

That said, it is not on Binance Smart Chain that there are no good projects, for example, PancakeSwap, from its predecessor as a fork of Uniswap on Binance Smart Chain, PancakeSwap has gradually turned itself into a force with a lot of systems. attractive features, causing the price of CAKE to decline, but show signs of recovery quite well.

But it is not because of this decline that BSC can be underestimated. Remember, behind BSC is CZ - a "player" is not simple. It is no coincidence that Binance has become the top-tier CEX, and has maintained its position to the present, so BSC can also be considered a name to watch out for in the future.

Learn more: BSC Ecosystem Overview: Opportunities for long-term investors

Solana

Solana is a blockchain platform listed on Binance for the first time since April 2020. As of June 2021, DeFi puzzle pieces have been formed, including typical projects such as Raydium, Parot, Mercurial, etc.

Serum currently cannot be seen as an ordinary DEX, but a place to provide liquidity for many of the above projects such as Raydium, Orca, etc.

However, the Solana ecosystem is somewhat slowing down, partly because the market is showing negative signs, partly because the projects are not outstanding. Partly maybe because the market is going down, on the other hand, maybe because the programming language difference compared to Ethereum has caused a lot of obstacles for project teams.

But that's just the current situation. Similar to BSC with CZ, Sam - Founder of FTX is also a very vocal person in the Solana ecosystem, and is actively supporting these projects, when the tokens in this ecosystem are listed in FTX. firstly. Personally, I think Solana still has potential for development ahead.

Learn more: Solana DeFi Ecosystem Overview: A Spectacular Transformation!

Terra

The time for the Terra ecosystem to form is probably only about 1 year. But since UST - Terra's stablecoin was started to be put into use, along with the launch of two important products: Anchor Protocol and Mirror Protocol, Terra's TVL has grown tremendously, to now be in the top 5. blockchain has the highest TVL DeFi.

Learn more: Terra Ecosystem Overview: Grow slowly but surely!

Summary

This is an overview article about DeFi 2021, specifically, we have carefully learned about the nature, composition, potential and investment opportunities in DeFi.

Right now, we are just in the early stages of DeFi & the whole crypto market. And what we need to do is to learn carefully about the topics and groups of coins that interest you before investing. I believe that only your own solid knowledge can help us make sustainable profits in the market.

With this article, I hope you can understand the basics of what DeFi is as well as the pieces inside DeFi. If you have any other questions or comments, don't hesitate to comment below to discuss with FoxCryptoNews!

Oct 14, 2022