What is Margin Trading? Trade Margin Experience for Newbies

What is Margin Trading? Should Newbies Margin Trading? Learn about the basics and experience of margin trading for beginners here!

Margin Trading, Long, Short are words you often encounter in discussion groups about cryptocurrency trading. Especially for those who are new to the market, they will not understand what these words mean.

In this article, FoxCryptoNews will bring you the most basic and necessary information about Margin Trading for those who are new to the cryptocurrency market, in order to help you have the right approach to Margin Trading.

What is Margin Trading?

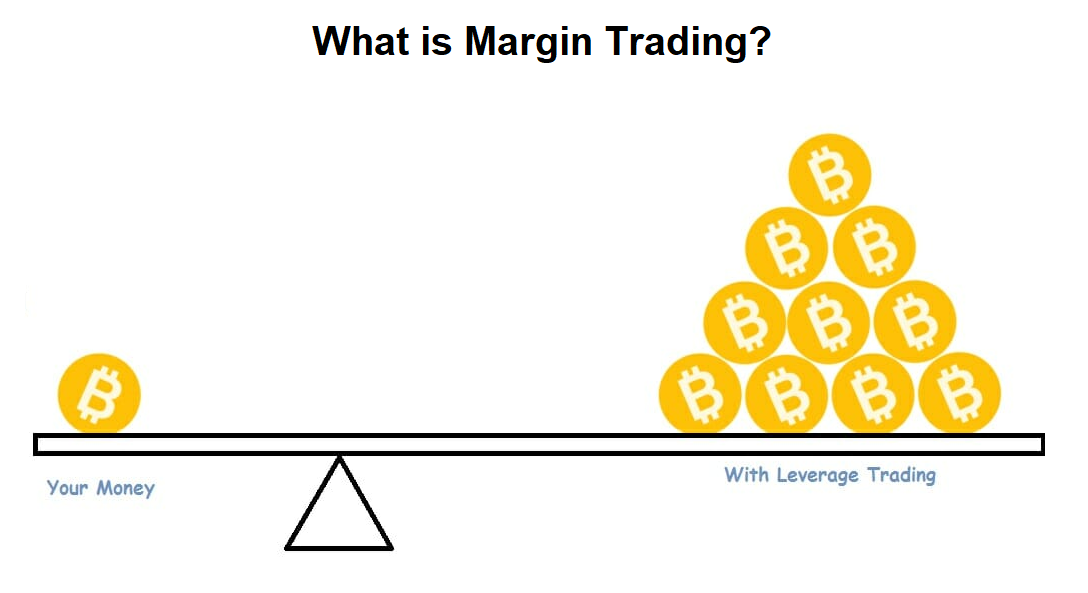

Margin Trading (or Trade Margin - Margin trading) is a form of trading using financial leverage, allowing to be able to buy and sell for a larger amount than they have. From there generate higher profits and of course the risk will also be higher than normal trading.

Margin Trading is a popular tool in low volatility markets like Forex, Stock Market. Currently, Margin Trading has also become popular in the cryptocurrency market, with the next trend being Crypto derivatives (Derivatives).

Advantages and disadvantages of Margin Trading

Advantages

For normal coin trade (spot trading), you can only make a profit by buying low and selling high. But for Margin Trading, you can make a profit regardless of whether the market is up or down .

At the same time, with the use of leverage, the amount of capital you can use to enter orders is much larger .

Defect

With the ability to generate high profits compared to the amount of capital you have. In return, when Trade Margin, you will have to bear a VERY HIGH RISK .

- For normal transactions, if you have the misfortune to buy high-priced coins and the coin price is much lower than the point of purchase. You still have a chance to wait for it to increase again .

- As for Margin Trading, if the loss exceeds the liquidation price compared to the entry point. Your coins will be sold and you have no chance for it to increase again .

| Spot Trading | Margin Trading | |

| Risk | Short | High |

| Opportunity to make profit | Buy low, sell high | Price can go up or down |

| Leverage | 1x | Up to 125x (depending on transaction) |

| Capital required | Higher (pays for the entire property you want to buy) | Lower (use leverage to trade with an amount greater than your capital) |

Basic Terms in Margin Trading

Before going into understanding how Margin Trading works, I want you to grasp some of the most basic terms when Trade Margin. Including:

Leverage

When using leverage, you can trade with money x times your capital. where x is a positive number.

For example: You choose 10x leverage that means you can use 10 times more money to trade than the capital you have.

Position

In Margin Trading, there are 2 positions including: Long and Short.

- Long Position: Shows a long position.

- Short Position: Shows a short position.

Liquidation Price

Liquidation Price is the liquidation price that when the coin price exceeds this price, the exchange's system will immediately liquidate all your coins on that order.

How does margin trading work?

The nature of the operation of Margin Trading

When you execute a LONG/SHORT order , leverage x with capital Y . This means that, to execute that LONG/SHORT order, you will borrow from the floor the amount corresponding to the formula:

(x - 1) * Y

Note: This formula will be specified differently for each floor. Which floor you play, you should consult first.

After closing the LONG/SHORT order, you need to return the exact amount borrowed from the exchange plus 1 loan service fee.

In case you enter a LONG/SHORT order, but in fact the price goes against your prediction . When the price hits the automatic liquidation price, the floor will liquidate to recover the loan amount, the difference in loss will be deducted directly from your original capital .

Trade Margin Example

Let's say, I have a capital of $10,000 , Bitcoin price is at $10,000 and I predict Bitcoin will increase to $11,000 .

If I trade normally with Spot Trading, I will make a profit of $1,000. But I want to optimize and increase the profit by 5 times. Therefore, I will open a LONG order with LEVERAGE 5x.

⇒ This means, I will create a BUY order at $10,000 with a volume of $50,000 . In the most ideal case, Bitcoin goes up to $11,000 and I close a LONG (sell) position, I will have a profit of $5,000 instead of $1,000 in the normal trade.

It can be explained as follows:

- When I made a Long order with 5x leverage , I essentially borrowed another $40,000 from the exchange to execute a BUY Bitcoin order at $10,000 , with a volume of $50,000 ⇒ I have 5 BTC .

- Then Bitcoin went up to $11,000 and I closed a LONG ⇒ That means I sold 5 BTC at $11,000 and got $55,000 .

- Next, I have to pay back $40,000 borrowed from the exchange plus a service fee ⇒ As a result, my capital increased from the original $10,000 to $15,000 (+50%).

Each broker has a different Liquidation Price calculation for each different leverage. So before placing an order, you should find out how margin trading on each exchange works!

Should Newbies Use Margin Trading?

Indeed, Margin Trading is a very good financial tool for retail traders.

However, using Margin Trading requires understanding, grasping the basic knowledge of technical analysis to analyze price charts, combined with seasoned experience and a spirit of steel discipline, to avoid risks. The highest risk you may encounter is account fire.

Therefore, those who are new to the market and have no knowledge should not touch this hard-to-swallow food.

Reputable Margin Exchanges

In each exchange, there will be a different way to calculate the fee and the amount of the loan, and the liquidation price. If you use any exchange, please carefully read the regulations of that floor before trading.

Details: 03 best Margin Trading Crypto exchanges

BingX

With an easy-to-see interface and good support team, BingX in my opinion is probably the best CFD trading platform right now. In addition to the web version, Bingbon is also known by users for its mobile application.

Register and Trade Margin on BingX now at: foxcryptonews.xyz/bingx

A huge plus of BingX besides enthusiastic support is constantly updating hot assets for you to participate in transactions.

In 2021, to meet user demand, Bingbon has launched the Spot Trading feature, allowing you to buy and hold like any CEX exchange.

Details: Review & Instructions for using BingX

FTX

Despite being a CEX exchange, FTX is famous as one of the "top" derivatives exchanges. Behind FTX is Alameda Research - one of the Market Makers and at the same time the most famous Crypto investment fund.

Register & Trade Margin on FTX now at: foxcryptonews.xyz/ftx

In addition to conventional derivative products, FTX also has Leveraged Token. According to many brothers, although buying and selling Leveraged Token is a bit confusing, if you get used to it, it will be quite "addicted" because of the risk associated with huge profits.

In addition, the calculation of the leverage of FTX is also slightly different from that of regular exchanges, that is, no matter how much you adjust the leverage, the actual amount of money for the order (multiplied the leverage) will also be the same. , differ only in the principal amount. From there, it affects the amount received/lost when the asset price increases or decreases.

Details: Evaluation & User Manual of FTX

Binance

In Crypto, perhaps no one does not know Binance as a current top 1 exchange by trading volume, as well as the reputation of the exchange.

Register & Trade Margin on Binance now at: foxcryptonews.xyz/binance-bnb

Although not as famous for derivatives as FTX, Futures on Binance is also considered a popular product, perhaps second only to Binance's Spot. This is shown a lot by showing off pictures of the members' profits in many groups.

But there is one feature that you probably know for a long time, that is, the Futures price on Binance often has very strange "beards", killing a lot of orders, regardless of whether it's long or short. This incident is probably not only famous in the Vietnamese community, but also the world, so when playing Futures on Binance, you have to be careful.

Details: Review & User Guide of Binance exchange

Trade Margin Experience

Always have a trading plan before entering an order

This is a constant if you want to succeed in normal trading, especially Margin Trading. You need to prepare yourself a clear specific trading plan and follow the discipline according to that plan.

Before entering an order, it is necessary to determine the entry point, take profit point, stop loss point, what is the win rate, how much leverage to use, etc. There are a lot of things you need to draw out on the entry plan.

Do not use borrowed capital to enter orders

There have been many cases of borrowing money from other people to play and then burning the account, leaving heavy consequences for both the borrower and the lender.

If you play Margin Trading, consider how much you can lose and never go all in on 1 order.

No DCA with high leverage

DCA (Dollar-Cost Averaging) or price averaging strategy is a method of dividing an investment amount into several parts in a fixed, regular manner over a long period of time.

The example is easy to understand as follows: The sideway market accumulates, you buy 1 amount of ETH worth $1,000, after breaking the resistance, you predict the price will enter a strong bullish zone, so you continue to buy more. at $1,400.

When using high leverage, you are taking on higher risk than with low leverage. Therefore, be balanced and stick to the plan you have set.

Use Margin as a way of “insurance”

This is a relatively strange tip for newbies, but very often used when you want to participate in IDO (Initial DEX Offering).

For IDO: If you buy an IDO platform token to join IDO without thinking that the token will increase in price in the future, otherwise you are afraid of a price drop, leading to a loss if you don't win the IDO slot, then you When buying, SHORT the token for an order of equivalent value (leverage included).

- If the token price increases, the Spot buy position participating in IDO will be profitable, the short order is negative.

- If the token price falls, the spot long position will lose profit, the short will be positive.

In any case, the profits of both positions will compensate for each other, you will not lose money when participating in IDO, or more broadly buying tokens to farm or do something, but not for long term.

"Temporary loan" to buy Spot right at the desired entry

Assuming SUSHI at $8 is very nice, but unfortunately the payday hasn't come yet, is there a way to "get on the boat"?

Actually, this isn't exactly a tip, just a way of thinking more openly about margin. Margin (long) or buying Spot is essentially buying an asset, waiting for the price to increase, and then selling . Therefore, you can take a long position corresponding to the amount you intend to buy (including leverage), which is not very different from buying Spot.

Of course, this can only be done when the brother's assets are no longer Stablecoins, but there are other assets as collateral that are large enough to not burn.

For example: You have $20,000 worth of assets in FTX, you can comfortably long a SUSHI order with the value of a month's salary (~$500), for example, because it is difficult to burn up to $20,000.

Speaking of borrowing, on the FTX floor, there will be an additional feature of borrowing Stablecoins to buy Spot, so if you are afraid, you can still use this feature.

Conclusion

I believe that after reading this far, you must have understood the most necessary and basic information about Margin Trading. Hope you are well aware of the opportunities and risks when using Margin Trading. Especially those who are new to this tempting cryptocurrency market.

Oct 14, 2022