What is EIP-1559? How will Ethereum change with it?

EIP-1559 will change the Ethereum fee market mechanism. In this post, we answer the key questions Ethereum owners, dapp users, and developers have about EIP-1559, which will be listed on the London Hard Fork in July.

What is EIP-1559?

EIP-1559 make the Ethereum change fee market mechanism. Essentially, EIP-1559 eliminates the first auction as the primary way to load gas. In a first-price auction, everyone offers an amount that must be paid for their transaction to be processed, and the highest bidder wins. With EIP-1559, there is a separate "base fee" for transactions included in the next block. For users or apps that want to prioritize their transactions, they can add "tips," known as "priority fees," to pay miners for faster inclusion.

As an analogy to explain basic fares and tips, imagine the experience of using a ride-sharing app on your phone (for example, Uber, Lyft, or Didi). You want to use this app to travel from A to B. The cost to get from A to B is the same no matter which driver picks you up (fare based on EIP-1559). Now, imagine if you could add a tip to your driver before getting in the car. If your tip is higher than what others are currently offering, the driver is more incentivized to pick you up than other potential passengers who don't tip.

The process is similar to your ETH transactions: you can tip miners ("drivers" in the example above) so that your transaction moves on to the next block ("ride" in the example above). A higher tip means that there is a higher chance that your transaction is included in the next block and thus completed.

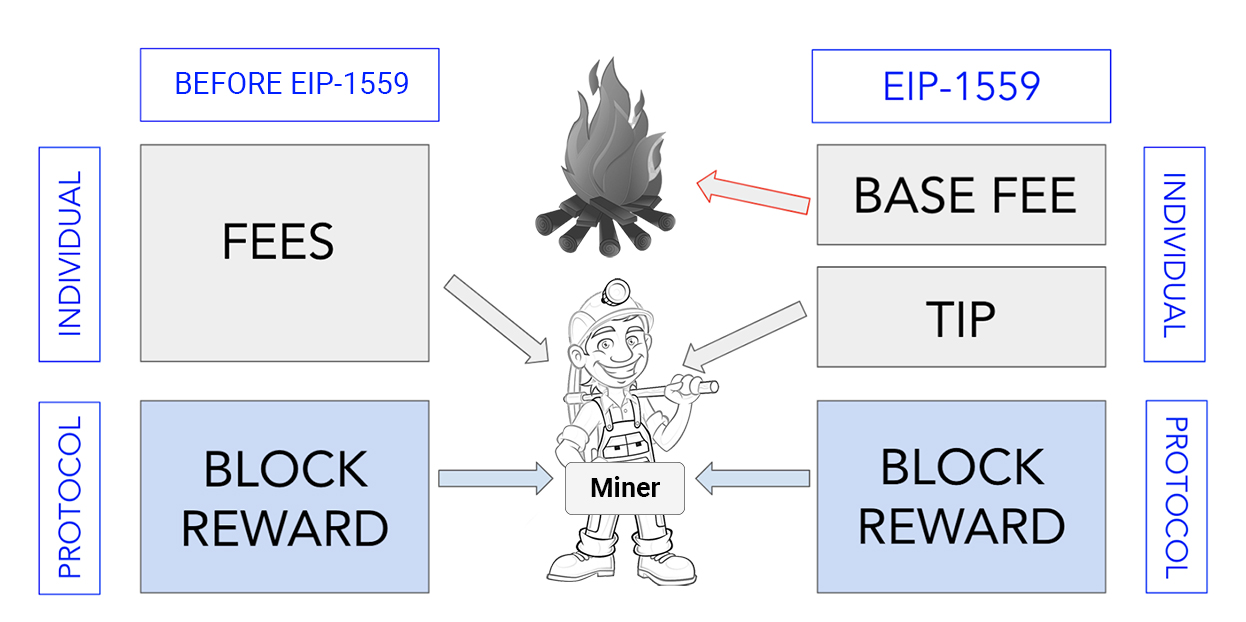

The diagram above shows how the payment mechanism work with the EIP-1559. Fees are currently paid to miners, who also receive a block reward of 2 ETH per block, plus the uncle rewards. With EIP-1559, the base fee be burned, but the tip and block reward still belong to the miner.

Pre-transaction fee system EIP-1599

Ethereum prices transaction fees using a simple auction mechanism known as the first price auction. The mechanism involves users submitting a transaction with exchange rate incentives, also known as gas prices. Miners choose the transactions with the highest bids to include in the block. The transactions selected by the miners must pay the offer they specified.

This bidding system cause bottlenecks in the system and increase gas prices in the network. This also results in some users paying more transaction fees (gas fees) than others in the same block.

How EIP-1599 fixes this system

EIP-1599 removed the first price auction mechanism to calculate transaction fees. In the EIP-1599 update, there is a base fee for all transactions included in the next block and a priority fee to speed up transaction processing. The base rate fluctuates based on network congestion and then runs out.

The user sends a fee higher than the base fee with the transaction. When the base speed fluctuates with network congestion, users can set a rate limit. Once included, the user only has to pay the difference between the last base rate and the highest interest rate.

These changes in the transaction fee system allow users to better estimate costs because the base fee is the minimum price included in the next block. In general, this result is in fewer users overpaying for transactions.

EIP-1599 fees burn mechanism

Another significant change under EIP-1559 is that a portion of the base fee is burned or removed from circulation, reducing the supply of ether and potentially increasing the price of the asset.

But this does not necessarily mean that Ethereum is a deflationary asset. In an interview with CNBC, CoinShares Chief Strategy Officer Meltem Demirors said that EIP-1599 alone does not cause Ethereum to deflate.

“Many of these expectations are likely to be overly optimistic in the short term and become more important in the longer term,” he said, adding that “nominal gas output does not exceed network inflation.”.

Do this make gasoline cheaper?

No, this is not the purpose of the EIP. As a side effect of a more predictable base rate, EIP-1559 could lead to lower gas prices if we assume that rate predictability means users are overpaying for gas less often. With EIP-1559, the base fee is increased and decrease by up to 12.5% after blocks are more than 50% full. For example, if a block is 100% full, the base fee increases by 12.5%; if the full base rate of 50% is the same; if it is full 0%, the base rate is reduced by 12.5%.

Continued application migration to Layer 2 and roll-ups result in significant rate reductions.

How do this change the user experience when setting transaction fees?

The idea is to make the block's demand-based fees more transparent to users. Wallets like MetaMask is able to have better estimates and won't have to rely as much on external math, since the base fee is managed by the protocol itself.

Does the user need to choose a transaction fee? If so, how do they determine the appropriate amount?

The wallet provide predefined settings based on the urgency of the transaction for the user. With MetaMask, users still have the option to set their transaction priority as "low", "medium" and "high", based on the estimated usage of the previous block and the type of transaction.

Do the typical user choose a "tip" amount, or is it part of the user's pre-selected overall fare?

The "tip" will be included as the general "gas rate" the user sees for submitting a transaction. You will also be able to “edit gas rate” to increase or decrease the “tip” known as “priority charge”.

Do the user experience be different in times of network congestion?

During periods of high network congestion, the installation fee is adjusted by 12.5% depending on demand beyond the ideal gas limit per block until that demand subsides. Instead of bidding on the first price, users get a better understanding of how congested the network is due to the high base rate. If it is too congested, the user may or may not pay that price, just as if they were buying an item in a store. Or they submit a lower rate and wait for the price to drop in the future.

Can anyone see where they tipped? Do block explorers like Etherscan now display this information?

This job is pending. Most likely yes, most tools are updated accordingly to display new information related to EIP.

Aug 20, 2022

-400-400.webp)