All about The Merge

What are Proof-of-Work and Proof-of-Stake?

Proof-of-Work (PoW) is the process by which miners validate, aggregate transactions, and broadcast them to the network of nodes on the Bitcoin blockchain. This transaction aggregation requires miners to compete with each other to find a valid cryptographic hash. That's why it's called Proof-of-Work - proof that a miner expends energy trying to find the cryptographic hash function and gain the right to synthesize and validate transactions.

On the contrary, to solve the problem of Proof-of-Work's energy consumption, with Proof-of-Stake (PoS), the network will rely on the ETH balance that the validator is staking into the network to choose who can. gain the right to authenticate transactions and receive rewards.

Proof-of-Stake is an idea that was first proposed in 2011 in the BitcoinTalk forum. Vitalik Buterin borrowed this idea to build a defense mechanism for the Ethereum blockchain instead of Bitcoin's PoW, according to the whitepaper written in 2013. The idea was that, but in reality, the Ethereum blockchain was launched with PoW first. because building a PoS blockchain at that time was “not easy”.

At that time, Vitalik still thought the transition from PoW to PoS would only take a year.

So far, it has lasted for 6 years, and this journey is coming to an end to open a new chapter in Ethereum's history - a history called Proof-of-Stake.

The Road to The Merge

Ethereum has gone through more than 10 forks and updates since the whitepaper was released in 2013. Many forks and updates have referred to the term “difficulty bomb”. The difficulty bomb is a scheme to increase the difficulty of generating cryptographic hashes in the PoW mechanism, meaning that miners will spend more energy in validating and aggregating transactions. This will become the impetus for them to switch to using the PoS blockchain, but in a time when the PoS blockchain is not ready for launch, the difficulty bomb will be an obstacle for Ethereum users as the cost of use increases. up too high. That is why in previous updates, the problem of difficulty bombs was always postponed so that the Ethereum team could focus on perfecting new features for this blockchain platform.

In October 2020, the staking smart contract on the PoS blockchain was deployed on the Mainnet. Users will need to stake a minimum of 32 ETH into the deposit contract to become a validator on the ETH 2.0 blockchain (blockchain using PoS, aka Beacon Chain). By the end of November 2020, the ETH 2.0 contract has reached a full stake of 16384, which is eligible for the Beacon Chain to start launching.

On the first day of December 2020, Beacon Chain officially produced the first block.

However, the Beacon Chain using PoS and Ethereum's Mainnet then still operated independently: the Mainnet (called the execution layer) would be responsible for transaction aggregation and validation, and the Beacon Chain (the consensus layer) would have role of controlling the consensus mechanism between validators.

In the period from the end of 2020 until now, the Ethereum team has conducted many updates to improve the issue of gas fees on this blockchain, such as:

– Berlin Update: Starting from block number 12,244,000, this update improves gas fees for some Ethereum tasks and supports more transaction types.

– London Update: Launching from block number 12,965,000, an important improvement in this update is the adoption of EIP-1559 to make transaction fees more predictable for users and to introduce deflation. to ETH. ------------

By October 2021, the first update for Beacon Chain – Altair (star Niu Lang) – was officially released. This update introduces some changes in the reward-punishment mechanism for validators.

Specifically, the slashing level and the validator reward level will both increase. In addition, this update has made it possible for users to run the node using only basic devices such as phones without the need for a third-party infrastructure. These users are called light clients. With the help of a sync committee (a data synchronization committee, consisting of 512 validators, randomly selected by the Ethereum network and changed every 27 hours), the light clients will not need to use the process. more data to validate transactions as before; Instead, the sync committee is responsible for signing the block headers, and the light client only needs to reconfirm these signatures.

The other two updates late 2021 (Arrow Glacier) and mid-2022 (Gray Glacier) mainly revolve around delaying the difficulty bomb until Beacon Chain is ready to merge with Ethereum's current PoW Mainnet – The Merge.

Around June 2022, this merger took place successfully on two Ethereum testnets, Ropsten and Sepolia. By August, The Merge was stably deployed on the Goerli final testnet, bringing Ethereum's dream of realizing PoS on the Mainnet closer to the community. September 15-16 is the time when Ethereum developers estimate The Merge upgrade will take place.

In parallel with The Merge, this system includes four other important categories to form a solid system for the Ethereum platform to work, including:

- The Surge: increasing Ethereum's scalability through sharding. The Verge: allows users to validate blocks on Ethereum or even become validators without the need for huge data storage devices with hundreds of GB. The Purge: minimizes the amount of data that needs to be stored, especially data on the old PoW blockchain. The Splurge: implements a few other add-on features for Ethereum such as Account Abstraction or MEV mitigation…

See more detailed explanation of these 5 categories here: Vitalik Buterin Announces Development Roadmap for Ethereum Post-The Merge.

After The Merge, what will happen?

After The Merge took place, the validator still could not withdraw the ETH used to stake on Ethereum. Only when the Shanghai (Shanghai) update is implemented, users will have the right to withdraw the amount of ETH deposited and staked on Ethereum to their wallet. The time of Shanghai has not been announced, only estimated to be 6-12 months after The Merge.

The Ethereum team will still continue to add many new updates after The Merge, such as Single Secret Leader Election (ie block proposer of the next block will not be disclosed, helping to avoid DoS attacks), Proof -of-Custody (helps encourage node to actively validate data in block), increase wallet/smart contract address length from 20 to 32 bytes to limit the possibility of attack by quantum algorithms) … Especially, after the Shanghai update is implemented, users will have the right to withdraw the amount of ETH deposited and staked on Ethereum to their wallet.

All of these improvements are on the way to making Ethereum a better scalable, more decentralized, and more secure blockchain, thereby providing an opportunity for crypto projects to reach out. with more public.

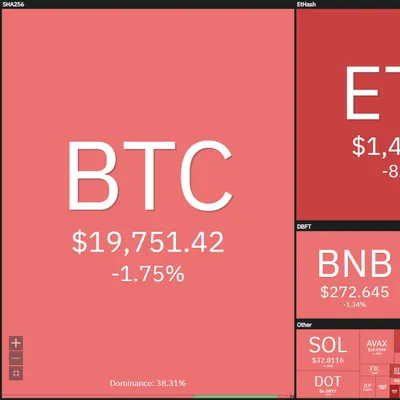

However, with mixed macro news ahead, will The Merge be enough to pull a warm summer back to the crypto market on Ethereum? Wait and watch it!

Aug 19, 2022

-400-400.webp)