CEO Do Kwon: "I and I alone are responsible for Terra's failure"

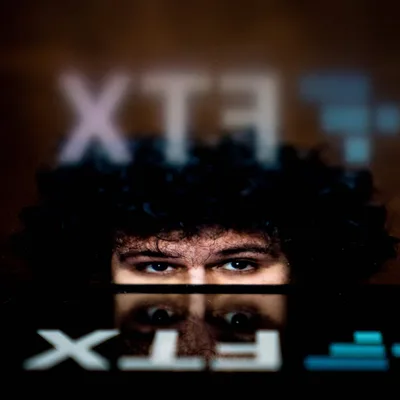

All the truth behind the story of Terra's collapse from the perspective of the project's founder was shared by Mr. Do Kwon in the latest interview with Coinage Media.

As Fox Crypto News reported, after 3 months of "silence" in front of public opinion about Terra's demise, CEO Do Kwon broke his silence for the first time through an exclusive interview with Coinage Media. The introduction video on August 15 revealed many details that the community is extremely looking forward to.

By dawn on August 16, the entire interview was broadcast. Accordingly, Do Kwon told the whole truth about his psychological development as well as what he faced in the face of one of the biggest crises in the history of cryptocurrencies.

EXCLUSIVE: @stablekwon Breaks His Silence. Coinage Episode 0 — Inside Crypto’s Largest Collapse with Terra Founder Do Kwon Watch the full video on our Youtube Channel ⬇️https://t.co/FqCnoZzApj pic.twitter.com/Vjd1KyADi6 — Coinage (@coinage_media) August 15, 2022

Journey to build trust about UST

In order for Terra to be able to stand and succeed, UST must always stay at 1 USD. For long-term survival, Terra by all means convince the community that UST is the best stablecoin offered to the market. So, Do Kwon devised solutions that make UST attractive not only to those in the crypto industry but also to everyday consumers.

Thus, Do Kwon and co-founder Daniel Shin founded Chai, a major digital payments startup in South Korea. Bottle allows people to use UST to make purchases without even realizing they are buying and selling in crypto. And when Chai succeeds in Korea, Terra has an undeniable competitive advantage.

“The idea that cryptocurrency is being used in the real world for everyday purchases is a breaking point for Terra, which is what first attracted me to the project and set Terra apart from countless others. competitor."

In 2019, when the market entered "winter", Do Kwon had a hard time attracting investors to join the project. During this time, he bought out Shin's ownership stake in Terra, leaving Shin free to develop his own Chai.

“We tried to raise more money for Terra in mid-2019, but the market was really bad.”

In fact, in June 2022, the Wall Street Journal reported that Chai had stopped using UST by the end of 2021. However, Do Kwon still advertises Chai as a strong adopter of UST, taking Chai as its base. A good example for investors to be optimistic about Terra's future in an interview with crypto investor Anthony Pompliano. To explain this incident, Do Kwon shared that he really didn't know that Chai had stopped paying UST.

Do Kwon used swagger and a cultlike Twitter following to build a crypto empire that collapsed in a $40 billion crash. Now the South Korean entrepreneur is attempting a comeback. https://t.co/TZu4Tq9pby — The Wall Street Journal (@WSJ) June 22, 2022

Back to the main topic, in order to continue "survival", Do Kwon had to find new ideas to promote Terra, which was still very young at that time. His big break came in March 2021, with the launch of Anchor Protocol - Terra's blockchain-based lending protocol, with a "smug" and "simple" business model of sending stablecoins. UST into Anchor and the platform automatically offers users a fixed annual interest rate of 20%.

As DeFi users flocked to Anchor more and more, LUNA quickly became a success. At its peak, more than $13 billion was locked in Anchor, representing more than 70% of USTs in circulation.

In the process, Anchor made Terra's launch pad "too big" to fail. However, nothing is impossible, with the imbalance in the mint-burn mechanism between LUNA/UST and the payouts from Anchor, Terra has completely collapsed in just two weeks.

Since then, it has led to the flow of information that Do Kwon's conservatism for extremely high interest rates (20%), despite warnings from developers is the cause of the failure. However, in the interview, he rejected this view, instead saying that he was very cautious when making the final decision.

“The internal consensus on what people want to do with interest is a couple thousand percent APR with Anchor from the start. This is still when DeFi returns are adopted by many projects that, they target stablecoin deposits, offer a few hundred percent APR, several thousand percent APR.”

A series of "tragedy" days hit Terra

On the night of May 7, 2022, Terraform Labs (TFL) made unannounced money transfers between teams. Thirteen minutes later, the attackers took advantage of this time, selling nearly 200 million USD worth of UST at once, and that surprised Do Kwon.

“I was in Singapore. I woke up in the morning to find the pool on Curve was unbalanced because someone made a very large transaction. My first reaction feels normal as this has happened before. I talked to a few people on Twitter, I got a few messages on Telegram and you know, I didn't act too much at the time thinking everything was going to be fine. However, things started to get worse. More and more anti-UST kernels appear on Curve. I've been posting on Twitter as much as ever to reassure the community."

Next, Do Kwon revealed the fact that the situation behind the story was quite complicated because his executive team was out of shifts at the time of the attack, they were all on their way to Singapore to attend the quarterly conference at Terraform Labs headquarters. The final transfer date and schedule of the company team are all inside information. Do Kwon believes there must have been a leak in his office.

“Only TFL staff know such information. So if you're asking me if there's a *spy* at the TFL, the answer is probably YES."

With the loss of confidence in UST, the price of LUNA also began to plummet, both of them continuously "dumped" each other strongly right after that, in order to "salvage" the situation, Do Kwon used "thoroughly" the number. funds are in the Luna Foundation Guard, including additional fundraising.

However, LFG's reserves kept dwindling and thousands of investors lost confidence every minute, all Do Kwon could do was watch UST's economy erased from the market.

“We are determined to put in more capital to have the resources to be able to fight. So we made the decision in just one night. We have called our existing investors in the LFG, calling many of the friends we have in the industry through many partnerships and large funds. I just can't find the words to describe how it feels. Terra is essentially my life. I bet it all on my actions and faith in Terra and I failed.”

Legal siege of Do Kwon

Not only was the Court rejected the appeal of the US Securities and Exchange Commission (SEC) in the investigation of Mirror Protocol - a project of Terraform Labs, but the "attack" from the Korean authorities was the worrying problem with Do Kwon at this point.

He is in the process of being summoned to testify before the National Assembly of Korea by a proposal from Congressman Yun Chang-Hyun. Not only that, CEO Terra also has to prepare to face a wave of fierce lawsuits from Korean investors.

In addition, the Financial Services Commission and the Financial Supervisory Authority - the two leading financial regulators in Korea, had to re-create the financial task force "Death" to investigate Terra. The Korean police also want to freeze the assets of the Luna Foundation Guard. The Korean tax agency finally came to a decision to fine Terraform Labs and Do Kwon $ 78 million for tax evasion before the Seoul Metropolitan Police Department redirected the Terraform Labs investigation to allegations of "embezzlement".

Despite being in a difficult situation, Terra's legal team left Do Kwon, quickly resigning simultaneously. However, Do Kwon himself decided to take full responsibility for the accident, besides sharing about the investigation cooperation process with the authorities.

“I and I alone are responsible for Terra. The reason is that the person who caused these holes in the first place, is none other than me.” In terms of due process, it's not about what you're prepared to face, it's about how you're going to deal with it. What we're going to do is we're going to bring out the facts that we know. We will be completely honest and deal with any possible consequences.”

The situation became so tense that between two days of Coinage Media's interview with Do Kwon in Singapore, South Korean authorities raided the home of co-founder Daniel Shin, as well as Korean cryptocurrency exchanges. The country has LUNA/UST listed on its books. When asked about whether to return to Korea because Korea has banned Terra developers from leaving the country, Do Kwon said:

“It was difficult to make that decision, because we never contacted the investigators. They have absolutely no contact with us.”

Stop or move on?

Immediately after the crash, Do Kwon launched Terra 2.0 – his quick attempt to start rebuilding his crypto “empire”, with no algorithmic stablecoins included, despite the many appearances. Rumor has it that he is "silently" building a new version of UST on Terra 2.0.

The new coin launched on May 28 (LUNA), different from the old LUNA (LUNC), was trading as high as 19.54 USD in the following days, and quickly corrected, is trading at 1, 95 USD.

Millions of USD of LUNA are traded every day and some loyal developers are still actively building on the new platform. But activity on the project's official forum is still sparse. Regarding the future of Terra 2.0, one of Do Kwon's concerns is that a lot of the core values of the community were built in the crash. He thinks they're ready to roll out interesting things on a standalone 2.0 platform.

“Most of Terraform Labs is still intact. We lost a lot of executives in the crash, but in terms of total employees, we lost a total of two developers. I will always do everything on Terra and for the Terra community. This is my home and this is where I feel like I have the brightest future.”

And certainly Do Kwon will not stop at this time with the statement:

“I love crypto. I love Web3. I plan to build here for a long time, and if my thesis is correct as we are in the early stages of what the market is going to be a Web3 world, then what do I think What I spend in the next 20 years will mean more than what happened in the last six catastrophic weeks.”

As for his daughter named after the project, Luna, Do Kwon expressed he has no plans to change her name.

“I want to keep the momentum going about the name I gave her. It's not something my daughter is ashamed of, it's something she's proud of."

Fox Crypto News Summary

Aug 20, 2022

-400-400.webp)