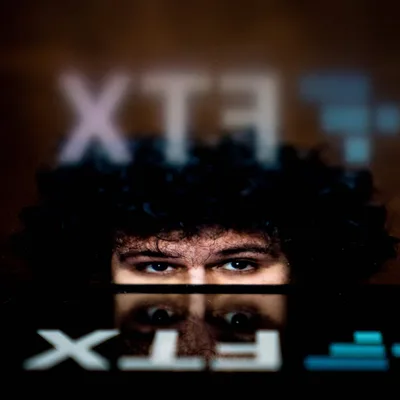

The new CEO of FTX commented that the exchange was "an unprecedented disaster".

Mr. John J. Ray III, who took office as the new CEO of crypto exchange FTX, said that he has never encountered such a serious bankruptcy.

Listen to this article

On the evening of November 17, Mr. John J. Ray III, who agreed to sit in the "hot seat" at FTX, the cryptocurrency exchange that went bankrupt last week, submitted to the court a preliminary report on the matter. company situation.

Although he has experience in handling many corporate bankruptcies in the US, the best known of which is Enron Corporation, but the new CEO must admit from the beginning as follows:

“In my career, I have never witnessed such a complete failure of business management and such a lack of reliable financial information. From infringing on system integrity and legal oversight, to concentrating control in the hands of a small group of inexperienced and possibly malicious personnel, the current situation of company is unprecedented.”

Other notable key points in Mr. John J. Ray III's report include:

– Former CEO Sam Bankman-Fried will be investigated.

– Alameda Research Foundation has lent $2.3 billion to Sam Bankman-Fried's own company, $1 billion to Sam Bankman-Fried personally, $543 million to Chief Technical Officer Nishad Singh and to Ryan Salame (a senior manager of FTX) borrowed $55 million.

– FTX claims only $659,000 in crypto assets, $1.1 billion in stablecoins, $483 million in cash and other miscellaneous items. The floor's total assets are $2.2 billion, many times lower than the $9 billion figure given by Mr. Sam Bankman-Fried.

– Sam Bankman-Fried did not include user assets in the liability section of the balance sheet.

– FTX does not control cash flow centrally, does not have a list of specific bank accounts and owners.

– Mr. John J. Ray III recommends that the court should not use the previous financial statements of FTX as a basis for making an assessment, because the level of reliability is not high.

– Unable to get the list of personnel who have been working for FTX.

– FTX corporate assets have been used to purchase housing and provide for FTX employees and advisors.

– Management approves revenue and expenditure by “dropping emoji” on request messages from employees.

– FTX does not maintain books or records of digital asset management, instead it is all in the hands of Sam Bankman-Fried and Chief Technology Officer Gary Wang.

– FTX has many internal vulnerabilities such as using public email to access private keys and sensitive information, not verifying blockchain data on a daily basis, using software to hide the use of customer funds. for the wrong purpose, there is a “secret mechanism to prevent Alameda from being liquidated on FTX” and there is no separation of management between FTX and Alameda.

FoxCryptoNews summary

Nov 18, 2022

-400-400.webp)