Binance CEO Changpeng Zhao liquidates all investment in FTX token of FTX exchange

Tensions between Binance and FTX suddenly "fired up" late on November 6, causing the FTT token price to dump sharply.

Listen to this article

* The article was continuously updated in the morning of 11/07/2022.

Binance announces full sale of FTT

Late on November 6, Binance CEO Changpeng Zhao made a shocking statement, that the exchange was the unit that sold FTT in the past. Specifically, when FTX acquired ownership of the exchange from Binance, Binance received $2.1 billion in the form of FTT and BUSD. However, considering the recent market situation, Binance has decided to sell the entire amount of FTT.

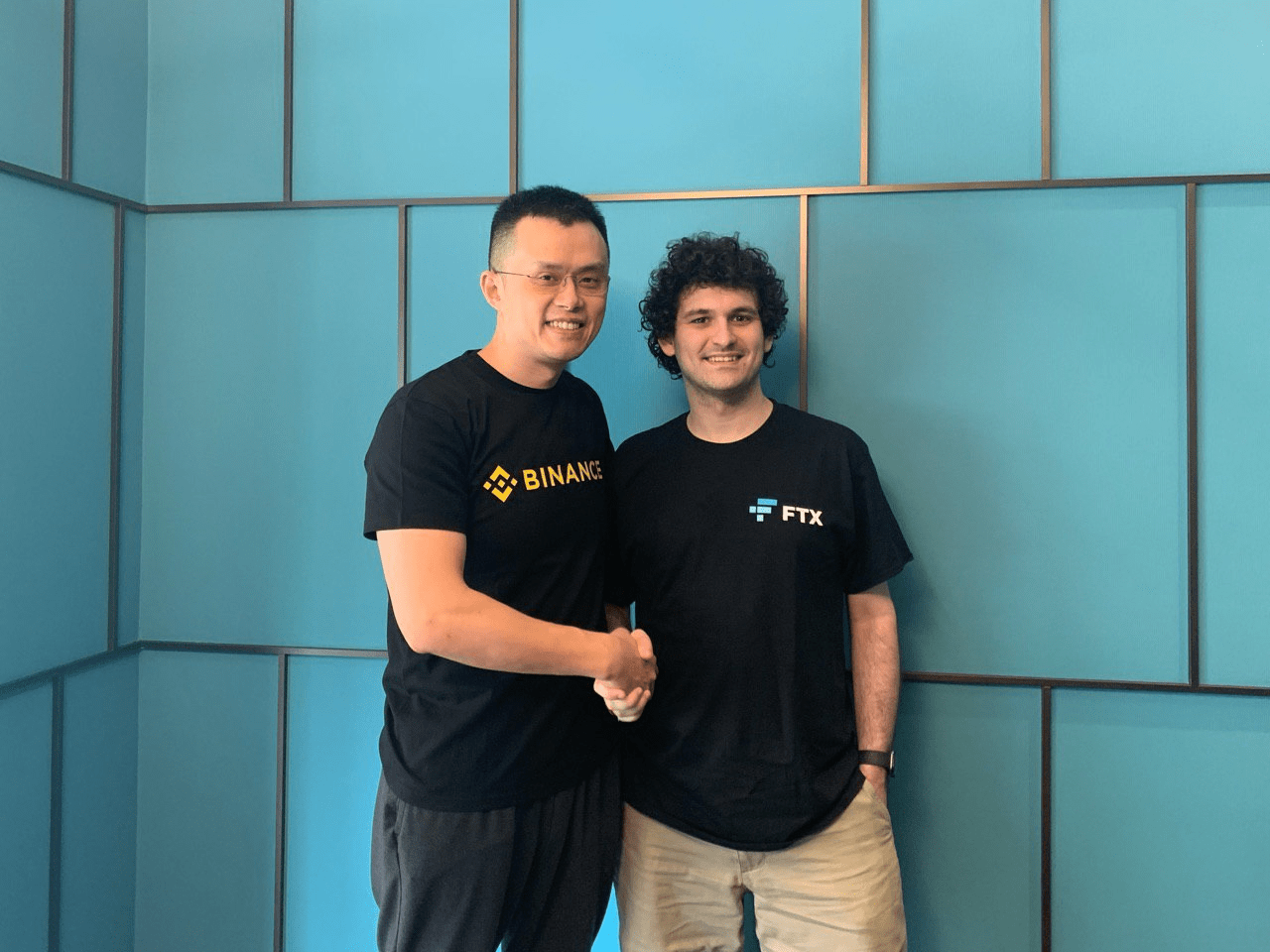

Binance admitted that it will sell FTT gradually over the months to reduce the impact on the market as much as possible. CEO Changpeng Zhao affirmed that he always wanted to have cooperation between the big boys in the crypto industry and said that the above action is not "playing bad luck". Binance also said it will usually hold investment tokens for the long term, and owning FTT since 2019 has demonstrated that commitment.

Binance CEO Changpeng Zhao and FTX CEO Sam Bankman-Fried recently sparred on social media over the issue of FTX spending money on acquiring troubled crypto companies. The two famous billionaires in the market are also curious about other "bad" rumors.

Even so, as assessed by FoxCryptoNews, it is a rare act from Changpeng Zhao and Binance to announce such an insider investment transaction to the crypto community, especially knowing it could have a huge impact on the crypto community. price line.

The FTT price dumped heavily after the Binance CEO announced the sale of FTT was posted.

Previously, as reported by FoxCryptoNews, the crypto community today spread the news that an address holding up to 23 million FTT (more than 580 million USD) transferred all funds to Binance. This amount was accumulated by the other address between December 2019 and December 2021, it is rumored that this is the FTT address of the Binance exchange, and through the above statement of the Binance CEO, information This has been indirectly verified. CZ also said “this is only part of it”, implying that Binance may even hold more FTT.

Rumors of Alameda Research Fund having liquidity problems

It is unclear if Binance's decision to sell FTT has anything to do with recent rumors related to the Alameda Research fund "sister" of FTX exchange having problems because of holding many illiquid tokens such as FTT, SOL, SRM , MAPS, OXY, FIDA… or not. Alameda Research CEO Caroline Ellison on the evening of November 6 denied the rumors, claiming that the disclosed information is only a small part of the fund and that the unit still has $10 billion unaccounted for.

Caroline Ellison later tweeted that Alameda would be willing to buy back all of Binance's FTT for $22 in order to "minimize the impact on the market,"

FTT price immediately recovered to the $23 zone thanks to the above post.

Answer from Sam FTX and accusations from CZ Binance

Around 01:00 AM on November 7, CEO Sam Bankman-Fried of FTX officially spoke about the entire drama. The CEO avoided talking directly about the tension between FTX and Binance, instead introducing the newly updated email or phone number transfer feature. However, Sam FTX still "sends" the following "reconciliation" words to CZ Binance as follows:

“I was about to write another post on a different topic, but I took a deep breath and reminded myself of something we should all remember: We are all a bunch of people in the same boat, and I wish the best to everyone who is helping the crypto industry grow.

I have a lot of respect for what everyone has done to make the crypto industry what it is today, whether those efforts are reciprocated or not, and whether or not we use them the same way. Even CZ.

Anyway, it's time to build, as usual.

Make love (and blockchain), not war.”

In response, Binance CEO Changpeng Zhao revealed more reasons for liquidating the FTT investment, implicitly accusing FTX of "playing bad" behind Binance.

“The liquidation of FTT is only risk reduction, which is the lesson we learned from the LUNA case. We used to support them, but we won't try to make up with them after we break up. We have no prejudice against anyone. But we will not support those who lobby against industry partners behind their backs. Let's keep moving forward."

Users massively withdraw from FTX

Meanwhile, there is information that users are massively withdrawing money from FTX, with the amount of stablecoins flowing out of the exchange in the last 7 days reaching more than 300 million USD, causing the balance of 261 million USD on FTX before the drama to dry up and have to thanks to Alameda Research to provide $257 million to ensure liquidity, according to data from Nansen.

According to Nansen, the institutions that have withdrawn the most money from FTX in the past 24 hours include the investment platform Nexo and the Jump Trading fund.

ETH withdrawals from FTX also hit a new ATH peak on the morning of November 7, according to CryptoQuant.

As of 11:30 AM on 11/07, the value of cryptocurrency in the hot wallet of FTX exchange has decreased from 2.4 billion USD to 1.8 billion USD in the last 24 hours, now there is no longer any ETH. or stablecoins but instead a large amount of FTT and altcoins.

FTX CEO Sam Bankman-Fried reassured that the exchange's situation is fine and has successfully processed billions of USD of deposits and withdrawals in the past hours, and thanked the users who still support and accompany the exchange.

According to information from the research unit TheBlock, Alameda Research wallet addresses have lost as much as $230 million in asset value in the past month – or 47% of total assets, with most of the funds being transferred to FTX and simple payments. Genesis lender.

Sam FTX “begs” CZ Binance to cooperate

On the evening of November 7, FTX CEO Sam Bankman-Fried gave his latest statement on the current controversy. Specifically:

– SBF claims to be being "badly played" by an opponent, spreading false rumors.

– FTX is fine, user's money is safe.

- The floor's assets still meet all user withdrawal requirements, the floor does not bring customers' money to invest.

– The exchange still processes withdrawal requests normally.

– FTX has over $1 billion in cash reserves and has a history of keeping user funds safe.

– FTX CEO wants Binance CEO Changpeng Zhao “to reconcile for the mutual benefit of the ecosystem”.

FoxCryptoNews summary

Nov 07, 2022

Skyrockets by More Than 58 This Week Amid New Binance Perpetual Contract Listing-400-400.webp)

-400-400.webp)