FTX encourages employees to deposit money on the exchange to keep it safe

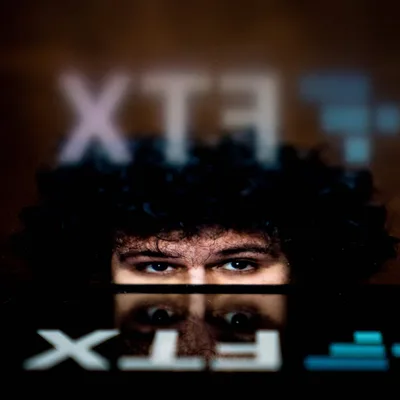

According to a confidential source from CoinDesk, FTX before the bankruptcy encouraged employees to deposit money into the exchange like a bank. Now, they can lose everything.

Listen to this article

Investment funds and institutions are not the only ones affected by the spectacular collapse of FTX last week. In addition to losing their jobs at the exchange, many FTX employees have deposited an amount of personal assets currently locked in the platform, at risk of being wiped out due to the gravity of the black hole called “FTX”.

According to a source of CoinDesk , FTX has an internal policy, committing to a discount of up to 50% to encourage employees to put their savings or invest in FTX. In addition, many employees did not withdraw their salary and bonus (paid by FTT) but left it on the floor because they thought it was convenient, they only exchanged it for cash when needed.

Now those who are stuck with money at the exchange can only resell the property at a price 10 times lower, because the "property rights" collectors assess FTX's ability to repay is relatively low.

Losing both lead and fishing rod, this time seems dark for those who have been working at FTX. Former FTX Chief Marketing Officer Nathaniel Whittemore said he and most other employees were unaware of the use of customer funds for unauthorized purposes.

“For me, all I feel is rage and anger because Sam and his peers did and have no intention of providing their employees with a polite text to explain their displeasure. talk about things to come.”

Before declaring bankruptcy on 11/11, many FTX employees have resigned in turn. Head of institutional customers Zane Tackett said on Twitter on November 10 that he had his company's Slack and Gmail accounts disabled without warning, and that his employees were currently "underwater" in the dark". Since then, many employees have spoken out and agreed with Zane Tackett they are in a similar situation.

Currently, FTX is in the process of corporate restructuring, converting to bankruptcy. Recently on November 15, the new CEO John J. Ray III held an internal meeting to reshape the company's apparatus, ready for the plan to complete bankruptcy under Chapter 11.

FoxCryptoNews summary

Nov 17, 2022

-400-400.webp)