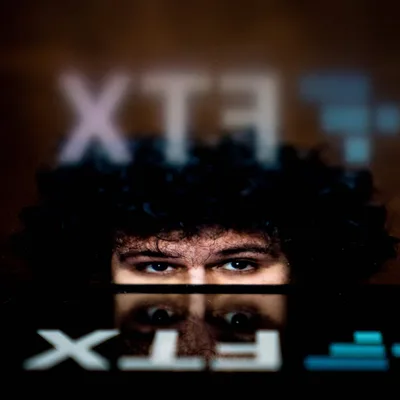

FTX CEO visits the White House as crypto regulation in the US is still a big challenge

FTX CEO Sam Bankman-Fried and his legal policy team met with White House policy adviser Charlotte Butash in May 2022, revealing many unknowns in the great ambition behind from the exchange.

This information is revealed in the statistics of the number of visitors to the White House in May 2022. Sam Bankman-Fried data shows that FTX CEO and FTX Director of Policy and Government Relations, Eloria Katz and Mark Wetjen, a former CFTC commissioner who is now head of FTX's policy team, visited the site. met with policy advisers Charlotte Butash and Steve Ricchetti. The document does not detail the content of the meetings.

It can be seen that this is considered a move to "befriend" the US government to strengthen the legal corridor of FTX. Just about two months ago, the CEO of FTX also planned to "donate $100 million" for the next US Presidential candidate. There have been many reports that the richest billionaire in the crypto industry will set up a "super organization" to mobilize politics in the US, but this rumor was refuted by Mr. Bankman-Fried shortly after.

FTX's Ambitious Proposal On the other hand, Mr. Bankman-Fried's White House visit comes as FTX currently has a proposal before the CFTC to allow the exchange to offer crypto derivatives trading. directly to users without going through any third-party brokers, first announced in March 2022 by the President of FTX. US Brett Harrison.

To clarify FTX's proposition, we first need to understand that futures trading is done using leverage, i.e., traders don't put 100% of the contract's value when entering a trade, but instead place only a small portion of the initial margin. Using leverage increases risk, as traders can lose many times their initial investment.

CFTC-regulated derivatives clearing organizations (DCOs) will help manage this risk with “clearing” contracts, i.e. standing as a counterparty to every contract. copper. DCO members are CFTC-regulated intermediaries, known as futures commission sellers (FCM). FCM accepts futures trades on behalf of their clients, collects margin, and registers it at a DCO. Thus, a DCO bears the direct credit risk of its FCM members, and FCMs bear the credit risk from their customers.

Next to the proposal FTX is asking to change its registration to allow the exchange to provide direct access to the clearing of Bitcoin futures contracts. If approved, it means that traders will no longer need to go through FCM to trade BTC derivatives on FTX, but can do it directly on FTX's platform.

FTX, as a DCO, will then bear the direct credit risk of traders in Bitcoin futures. To manage this risk, FTX proposes a model that automatically calculates margin requirements on a second-by-second basis, 24/7 and throughout 365 days, automatically liquidating the portfolio of undersigned members. 10% fund at a certain time until the account complies with the maintenance margin requirements or the entire portfolio is liquidated.

In theory, this real-time margin prevents investors from accumulating increasingly large losses. To the extent that FTX's order book is unable to process liquidations due to automatic liquidation margin requirements, FTX proposes to require backup liquidity providers to accept such orders. Finally, FTX will establish a guarantee fund that will cover any losses not supported by members or liquidity providers.

By eliminating FCMs as brokers or intermediaries in the Bitcoin futures market, FTX removes an important layer of investor protection. It is unclear whether and how well FTX ensures investors are fully informed of the risks involved in futures trading, especially for a volatile underlying asset. such actions, as well as clarifying any doubts about the exchange's ability to manipulate.

Is FTX putting pressure on CFTC?

And until May 2022, the CEO of FTX had to sit in a discussion held by the CFTC himself in Washington with the participation of many "professional" organizations in the derivatives field, such as CME Group to discuss the above proposal as well as negotiate the development of the industry.

Accordingly, most of the organizations participating in this meeting had opinions against FTX. CME Group CEO Terry Duffy stated that if the CFTC came up with an agreed solution to the FTX request, it would jeopardize the market.

Several other representatives also voiced their concerns about FTX's use of automated liquidity to respond to real-time market stresses. Even Gerry Corcoran, CEO of R.J. O'Brien & Associates, has called the adoption of such liquidations a “weapon of mass destruction” that “will create a flash cycle that will hit investors hard.

However, it is not yet known when the CFTC will make a decision on FTX's proposal. However, Mr. Sam Bankman-Fried's visit to the White House will certainly be the engine to "put great pressure" on regulatory approval.

Crypto Fox News Summary

Aug 31, 2022

-400-400.webp)